THE UNICORN: GANN-BASED MARKET MAKER ALGORITHM

As we were researching W. D. Gann trading methods on intraday markets, we noticed one technique coming out head-and-shoulders above the rest. In fact, it was pretty near perfect.

After experimenting with several variations, it became clear that this method had actually reverse-engineered the main algorithms used by the largest market makers driving intraday market movement. Each day it changes according to a formula- a very old formula.

This ‘Unicorn’ is based mainly on math. It works in such a way where machine learning is unable to discover it using the current collective data corpus and neural network. Since this algorithm appears to lead the market and track the market makers, it doesn't really conform very well to traditional technical analysis.

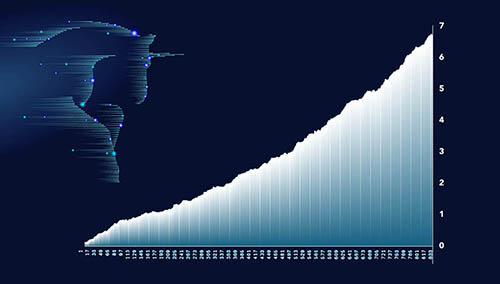

The equity curve to the right shows Unicorn "Algo #2" back-testing on the ES futures using 1 contract per trade on a $30,000 account from January 2023 through August 2025. The account grew by nearly 7 times to over $290,000! Testing includes subtracting slippage. This equity curve only represents 1 of the 4 algorithms we have discovered on the ES intraday regular US equities session. Our updated research points to market makers using 4 such algorithms in tandem to disguise their trading as market making. Soon we will display the results from all 4 ES algos.

For obvious reasons we are unable to post pictures or times and dates of trades. Losses are around 12% of trades, with break-evens incurring minor slippage. On the ES, the particular algo behind the equity curve trades about 1.8 times per trading day, being flat by day's end.

Unicorn algos can be calculated using a calculator or spreadsheet in under 2 minutes and implemented on TradingView or any standard market software. We have refined rules and back-testing results on ES and TSLA right now, and are hoping to discover how market makers are using Unicorn algos on other markets.

While the Unicorn appears to precisely track the main algo that market makers use, it may not fit everyone's trading mandates or risk profile. This reality appears to be the design of those employing it. Back-testing and equity curve results for Unicorn or any other market strategy should not be considered "typical." Intraday trading is not for everyone.

The Unicorn will be including only in the $9,300 option of our "W. D. GANN: MASTER THE MARKETS" Training but will only be taught orally. We'll only discuss the Unicorn over the phone (not in email or Skype, sorry) with those who display a serious interest in taking the Master The Markets Training AND whose identity we can verify.