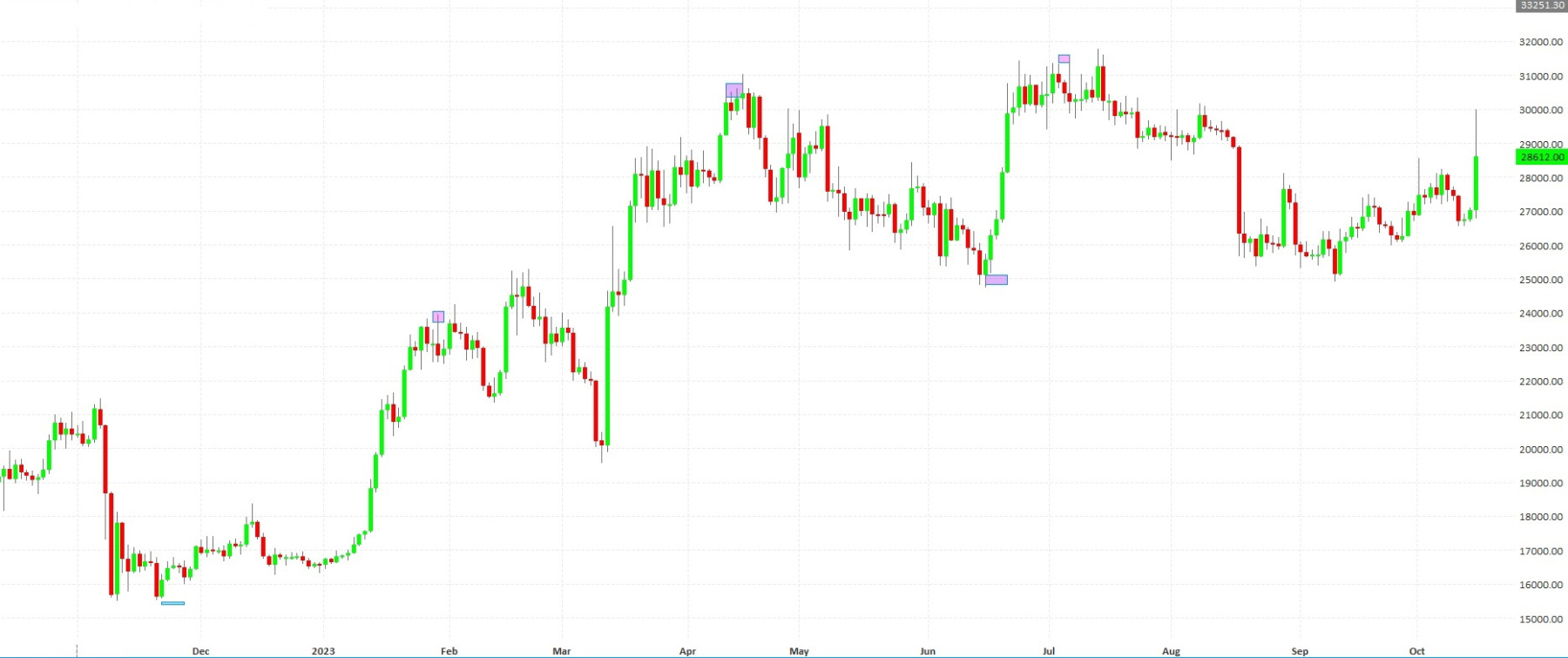

W. D. GANN BITCOIN PROJECTIONS

Applying conventional technical analysis to Bitcoin and most crypto currencies has proven extremely challenging for most analysts and traders. This is probably due to cryptos being a new asset class and going through what we call 'price discovery.' But Bitcoin is unable to escape Gann's Law of Vibration. The Law of Vibration seems to gravitate to the Bitcoin/USD currency pair and use it as sort of a foundational index. Using the Law of Vibration for price projections, price square-outs, and time square-outs are taught in entirety in our "W. D. GANN: MASTER THE MARKETS" Training. Though the Law of Vibration served as the foundation for capturing a market's fundamental vibration, Gann also used it as a specific formula for projecting swing prices and turn times. In the first scroll-through gallery below, 3 different techniques find confluence together to project price-and-time square outs. The basic anchor is the "range finder" square out to project an anchor price. This anchor price must then find narrow confluence with a swing price projection from the Law of Vibration formula. Finally, the time square out is added. A box is formed with both price projections, a time projection, and a small margin of error. Price must enter the price-time box within the allotted time for the projection to be valid and actionable. These transparent blue or purple boxes on the chart below contain acceptable error for both price and time. See gallery below for intra-month price-and-time square out swing projections. W. D. Gann wrote specific specific directions for projecting swing prices in this manner. He said we are to use and project "extreme" prices. That is, we are to project a new outside move of the market.