190 South LaSalle Street, Ste. 2100 , Chicago, IL 60603 | 312-532-2116

The Trading Methods of W. D. Gann

Arcanum Market Research

W. D. GANN: MAGIC IN THE MARKETS FAQ

Do you have a serious interest in “Master The Markets?” Contact us to arrange a visual “virtual-tour” of the training via Skype. The tour is interactive and visual. You can see how each technique is calculated and applied, and then walk through the strength of the back-testing. Plus you can ask all the questions you want.

Serious inquiries can also reach us by email or phone at: seminars@tradingwdgann.com or 312-532-2116 11am – 4:30pm CST M-F.

Following are the answers to some of the most frequently asked about W. D. Gann’s trading methods, and our “W. D. Gann: Master The Markets” Training. As this entire website is designed to save us time on the phone, the detailed answers below should clear up a lot of the questions you have before calling us.

HOW ARE W. D. GANN’S ‘UNPUBLISHED’ TRADING METHODS DIFFERENT?

The methods taught in “Master The Markets” differ from most everything out there labelled “Gann” in 3 important ways:

- Each one of Gann’s trading methods has been ‘decoded’ from his writings.

- Each one of Gann’s trading methods is completely objective and rule-based.

- All of Gann’s strategies and most individual techniques have been statistically proven by back-testing.

The real market mechanisms discovered and employed by W. D. Gann bear little resemblance to what he described and illustrated in his books. Most everything commercially available labelled ‘Gann’ is simply a new arrangement of descriptions and diagrams from Gann’s books and courses.

Gann sold his private courses for the equivalent of $60,000 and up in today’s money. He never intended to teach his real trading system in his publicly sold books. He wrote them to draw in more private students and coded a review of his real techniques & strategies to the students he taught privately.

If you have been unsuccessfully trying to decode and trade with methods derived from a face value interpretation of what Gann wrote, it’s far from your fault. Gann never intended anyone to walk away from one of his books with knowledge of how his methods really work. Unless any technique or strategy is built upon the foundation of Gann’s Law of Vibration and the correct vibration of each market, it will always operate inconsistently and unreliably.

Gann’s unpublished techniques are rule-based and objective. They reduce to precise mathematical formulas which can be modeled and back-tested. “Cottage Industry” Gann is usually typified by subjectivity, vagueness, and inconsistency.

CAN I DO THIS?

The unpublished market methods and strategies Gann really used to trade are objective and rule based. They can be taught and replicated. If you are basing this question on your unsuccessful experience with ‘bad Gann’ (typified by subjective gut-feels, mysterious premises, incomplete rules, and immeasurable and inconsistent results,) please re-read the previous sentence.

Gann’s unpublished methods are hard to find, easier to do. We’ve spent the last 20 years going down over 100 roads for each technique, only to find 1 that works. We have done the hard part so that you can do the easier part.

The modern quant trader, analyst, or machine learning modeler will find the constants Gann used in his math and formulas refreshing. Quant formulas usually involve a lagging measure of past price action or volatility in order to populate future variables. This means W. D. Gann’s formulas and market techniques are truly objective. You can draw out cycles or trend predictions years in advance.

If you have invested in a hoax for years, the methods taught by us will be unable to provide the key to fix your ‘broken Gann.’

A warning to “tinkerers.” If you plan to use Gann to spend all your time golfing except for the one morning Gann tells you in advance the market will go up 100 points, then go back to golfing- keep dreaming.

If you just want to find once-in-a-lifetime buys at the extreme low price, like Ford at $1 in 2008, Dogecoin at $.01 in January 2021, McDonalds at $12 in 2003, or Bitcoin at pennies in the 2010s, you can do that without Gann. Just use your common sense. But if you want to scale up that experience into consistent market participation, you will need Gann for that.

Read more details about ‘Master The Markets’ and Gann’s methods.

WHO TAKES ‘W. D. GANN: MASTER THE MARKETS?’

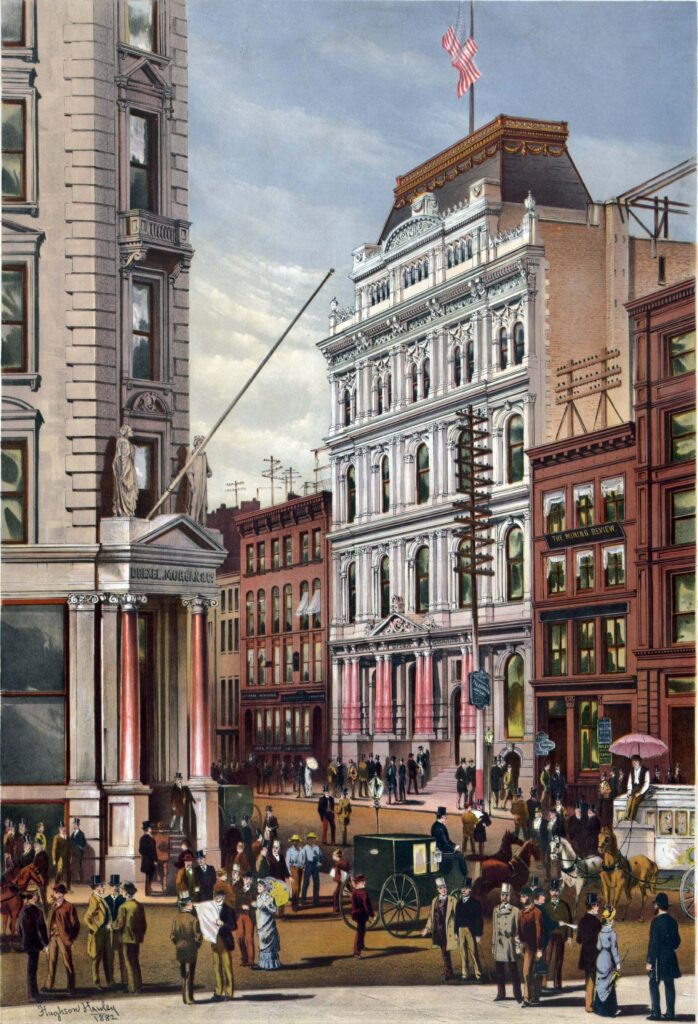

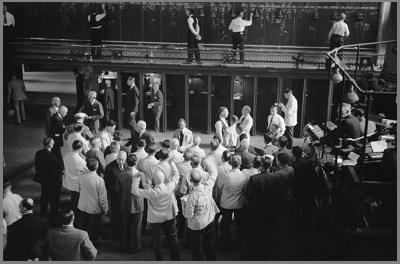

Trading professionals in Chicago were the first ones to take “W. D. Gann: Master The Markets” through word of mouth in the industry over 10 years ago. That early interest catalyzed the foundation for the larger volume of Gann’s methods and strategies that comprise the training and manual today. Industry professionals still make up a large part of our alum today.

Recently, we’ve seen a new breed of industry professionals looking to go beyond the limits of contemporary current market analysis.

Obviously, Gann Aficionados comprise a large portion of ‘Master The Markets’ alum. Like some of you reading this, there are those bitten by the Gann bug who would be embarrassed to tell anyone how much time and money they wasted chasing rabbits before they took ‘Master The Markets.’ There’s few things more satisfying than to have played a part in culminating that journey for so many.

Others have taken the training for reasons other than trading. Some are wealthy individuals who feel gaining this knowledge makes them more informed and less fearful about the global marketplace. Others have been esoteric researchers who take ‘Magic’ to enhance their knowledge base. Others still are analysts in search of an unrivaled edge in predicting the markets.

HOW CAN I PREPARE FOR ‘W.D GANN: MASTER THE MARKETS’ COURSE? ARE THERE PRE-REQUISITES?

VIEW OUTLINE OF TRAINING . Before the 4-day training sessions we also have live, interactive preparatory webinars and consultations to help you hit the ground running.

Those who have the most success with ‘Master The Markets’ are active traders with adequate capital who already have an organized approach to the market. Reducing risk & drawdown, achieving greater consistency, filtering out bad trades, better timing, precise pricing, and organizing their approach are all common ways trading professionals benefit from the training.

Future traders wanting to get right foot and build their market philosophy, trading style, on the proper foundation of how the market really works benefit avoid wasting years and thousands of dollars on faulty, incomplete, and inconsistent methodologies.

With the exception of Earik Beann’s “Handbook of Market Esoterica,” everything currently commercially available will be worthless in preparing you for “W. D. Gann: Master The Markets.” It may even screw you up. Even very expensive books and course will not aid in preparation.

There are a few books on Gann’s recommended reading lust we can submit that will help you become familiar with some of the more intricate concepts in the training. These are helpful but far from necessary.

DO YOU GIVE PREDICTIONS, TRADES, OR ENTRIES AND EXITS IN ADVANCE TO THOSE CONSIDERING THE COURSE?

No for many reasons, but we used to. Most of the market strategies in “Master The Markets” are represented by statistics that reflect consistently high success rates over longer periods of time.

Let’s say you wanted 7 days worth of ‘predictions,’ even though you are clueless about what you just asked for. Now let’s say what you see is bang on all 7 days…even though the back-testing over time comes in at 80%. Judging the results by these 7 days would be just as dishonest as if whatever you asked for triggered all 7 days but worked none of them.

W. D. Gann was a professional trader, and his strategies and methods are geared for today’s professional trader. Market professionals judge success and suitability of a market strategy based on back-testing over a long period of time in several market conditions. They look for rate of success, but also look for qualities like drawdown, trade efficiency, and simplicity being consistent over time. That’s why we keep extensive and pictorial back-testing on strategies as well as individual techniques.

Many of the techniques and strategies in Gann’s arsenal employ a larger timeframe. Some let the market dictate the timeframe. Giving these signals in advance would seem awkward and schizophrenic if you are unaware of the underlying principles.

Another example. In the Soybean mechanical system, Gann used a certain squaring technique in an odd way to predict pullback prices. He then used the framing parameters of the Mechanical method to establish certain “time periods.” Finally, Gann set an expiration time for each price projection based on his proprietary use of these “time periods.” Trying to communicate, explain or gauge all that in one prediction is impossible. Gann measured and gauged the success of the system that organized those techniques over a much longer time.

Also, besides our work with the trading methods of W. D. Gann, we are consultants to market professionals here in Chicago. Around the shutdown of 2020, we had a rare chance to trade consistently. Since last year however, we have gotten to the point where we rarely have time to trade, especially consistently.

Let’s keep going on this question, because it opens a pleasant can of worms. On our “MORE ABOUT” page we describe how the “Master The Markets” training can be broken down into 2 parts. First, rule-based strategies and stand-alone techniques that are ready to trade out of the box.

Second are rule-based techniques which Gann used to compliment his strategies and combine with other techniques from time-to-time. But he refrained from showing them functions in a trading system. These have a particular use and fail to trigger some days. An example might be the market making a bottom formation into a price prediction box one day. Unless you know how Gann intended the techniques to be used and when it triggers, predicting it in advance would be useless.

DO I NEED SPECIAL SOFTWARE?

W. D. calculated and implemented these methods by hand. Technically, you can too. Most calculations can be done by hand in under 1 minute. Drawing out a monthly or annual cycle may take up to 1 hour by hand. A spreadsheet can also increase accuracy and decrease time.

Practically, you will probably want Wave59. Wave59 is uniquely designed from the ground up around the way Gann drew out charts and the ephemeris by hand. It pre-packages 2 to 3 steps of the process, so you can focus on applying the technique quickly. This is immensely helpful in the stage where you first learn Gann’s trading techniques and want to hit the ground running.

We provide Gann’s LOV software for projecting high and low prices in an Excel frame for speed. Included are chart templates and proprietary indicators with open code on Excel, EFS, and Wave59 Qscript.

No other software commercially available is able to do the progressions necessary for Arcana and draw out planetary degrees on a chart for cycles like Wave59. This is because Solarfire is set up so that all progressions must start from natal. Gann did it another way that Wave59 is uniquely designed from the ground up around.

Wave59 replicates the same way Gann drew out charts and the ephemeris by hand. This is immensely helpful in the stage where you first learn Gann’s trading techniques and want to hit the ground running.

In our community of alum there are a few people you will have access to that have spread-sheeted as well as automated some techniques in Wave59, Esignal, Tradestation, Ninja, and Optuma. They proved automation can be done with much of Gann. (Note: we are far from guaranteeing these individuals with impart their knowledge if you take the course, especially for free.)

WHAT TIMEFRAME DOES GANN WORK ON?

Each of Gann’s trading strategies and techniques is timeframe-specific. Some of his most common timeframes are: Intraday, intraweek, intramonth, annual, and 2.5 years. Some strategies, such as the ’Mechanical Method,’ allow a runner lot to keep going until it reaches an out signal. The timeframe in that case is dynamic, and may range from 3-hours to 2-weeks based on what the market does on that day.

W. D. Gann discovered that each technique or strategy worked in a particular way on each particular market, and a particular time frame. Gann confined his trading to the one specific market and time frame that the technique he was using worked on.

In his “Stock Market Course,” over 85% of the trading results are displayed in one stock: US Steel, which was the market leader in volume and liquidity in that time as AAPL is today. Those trading results he displayed are grouped according to intraweek, and annual. This was all part of his objective, rule-based approach.

Each technique and strategy in ‘Master The Markets” find its own sweet spot on a particular market and time frame. We rank these matches in order of which perform best. Some techniques and strategies only work on a select group of markets and timeframes. For instance, we have the alternating cycles operating at a high level on the SP 500 futures in intraweek, month, year, and longer. But these results are unable to be cut and pasted on any other market or timeframe at this time.

The first step is to identify the market and time frame you are looking to trade in. If you want to hop haphazardly between markets and timeframes, it will be difficult for any trading strategy to benefit you.

Arcanum Market Research is one of the only we know to offer so many tested Gann techniques and strategies on an intraday level. But in doing so, the last thing we are trying to do is push people toward intraday trading. If you already trade intraday or are looking to make that their focus, you will be a kid in a candy store. If your focus is longer, then we will have a whole array of other Gann techniques and strategies for your timeframe and market.

Many of our clients are under mandate to interact with certain markets in a certain timeframe. These mandates are shared with their investors and regulators alike. For them, we locate the best ranking technique and approach, or methods that will integrate with their present approach and analysis to reduce risk & drawdown, pinpoint entries, better timing, and so forth.

PRICING OPTIONS

W. D. GANN: MASTER THE MARKETS

$9.300

TOTAL USD

DISCLAIMER

Futures, Equities, and Options trading/investing has large potential rewards, but also large potential risk and is not suitable for everyone. You must be aware of the risks and be willing to accept them in order to invest in the equities, futures and options markets. Do not trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures, stocks or options on the same. No representation is being made that any account will or is likely to achieve profits or losses similar to those W. D. Gann claimed or anything shown on this website. The past performance of any trading method, strategy, or technical analysis technique, system or methodology is not necessarily indicative of future results. No one associated with this seminar or Tradingwdgann.com are Registered Investment Advisors, Commodity Trading Advisors, or certified, registered, affiliated or approved in in any way with either the National Futures Association, Securities and Exchange Commission, Commodities Futures Trading Commission, or any other organization.

The “Master The Markets” training exegetes and replicates, as accurately as possible, the original technical analysis, strategies, and market techniques of the late W. D. Gann; and not necessarily the exact trading methods of course presenter or any other individual or entity. You may not be able to duplicate the results of W. D. Gann for many reasons, including, but not limited to, skill of the individual and the changes in financial markets since Gann wrote about them. Recipients of this course receive hypothetical, back–tested data and not actual trading results. Technical analysis, indicators, strategies, and market techniques, including any descriptions or evaluations of their performance, included in this course and displayed on this website, are described and evaluated based on hypothetical back-testing, and not the actual trades or earnings of any individual or entity. Hypothetical back-testing results are not “typical” results. Material includes far more applications to market instruments and time frames than the presenter can possibly implement. Author & presenter has sources of income in addition to his work with financial markets. In any and all descriptions of this course, or any information displayed on this website, no individual or entity, including past clients or course presenter, “hold themselves out” as achieving any level of success trading or amassing any level of wealth or income derived from any course offered on this website or any or all of the information displayed on this website.

“Master The Markets” teaches the individual technical analysis, market methods, strategies, and indicators we believe W. D. Gann used in financial markets, occasionally demonstrated by showing different ways Gann combined them to work together. Neither These combinations, nor anything displayed on this website or offered in any course on this website constitute a “futures trading system” or a “stock trading system.” Nothing shown or described on this website should be taken as any individual or entity claiming, inferring, or insinuating, investment advice in any way. No one associated with Master The Markets or this website accurately verifies or tracks results of past clients.

CFTC RULE 4.41

HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

CONTACT

ARCANUM MARKET RESEARCH

190 S. LaSalle Street, Ste. 2100

Chicago, IL 60603

312-532-2116

contact@tradingwdgann.com