BLACKJACK: TRADING W. D. GANN'S GEOMETRICAL ANGLES

Blackjack is our name for this trading strategy based on Gann’s true method of “geometrical angles.” Gann wrote much about this concept in various commodities courses toward the end of his life.

The root of this method is based in a certain type of numbered square. Through geometry, we find a faster method of applying key numbers within that square to a trading chart. Of course, all of this takes place within the framework of Gann’s Law of Vibration.

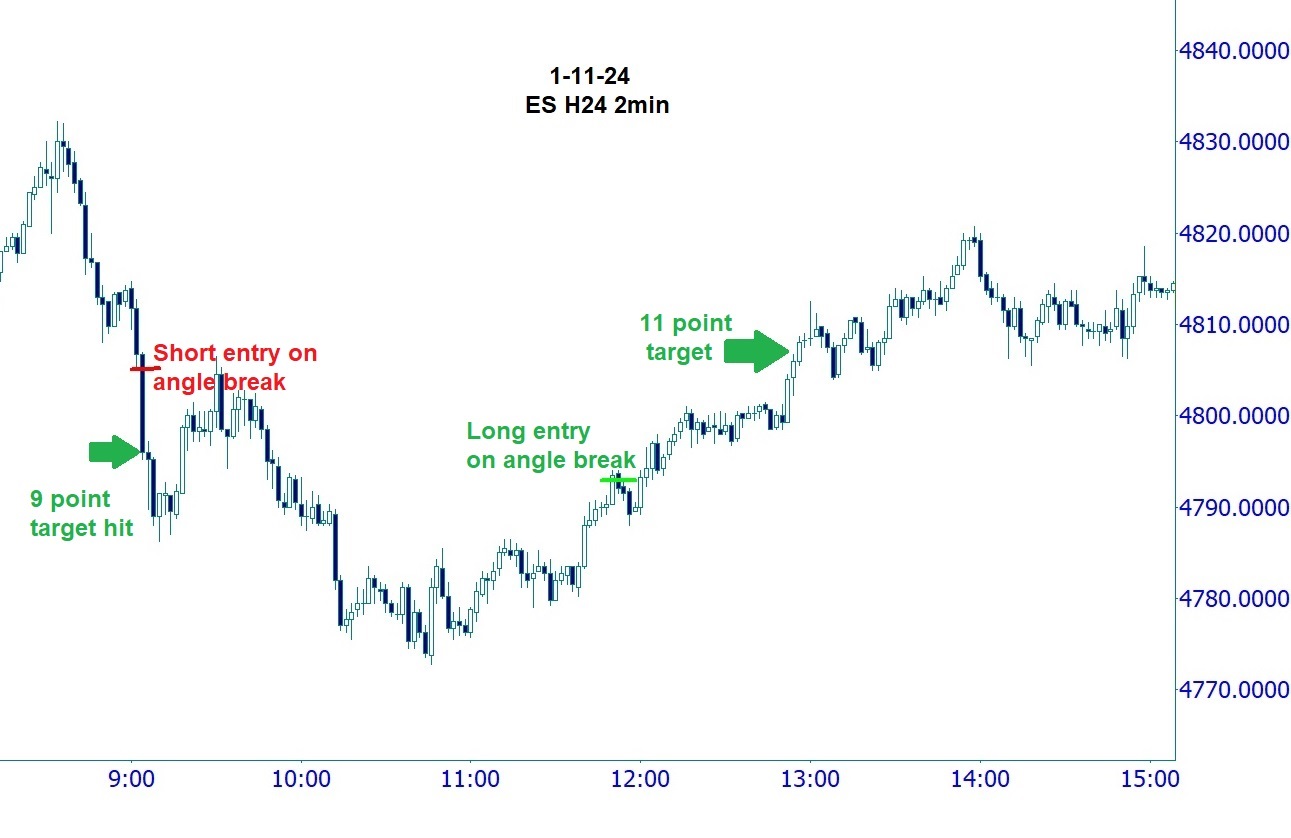

Featured on this page, you will find Blackjack applied to intraday SP 500 futures. The method applied to intraday trading averages a little over 1 trade per day. Each day you are flat by close. Based on numbers and angles, or fans, that are drawn in advance of market data, we derive a breakout/down point in price and time. IF this point is broken on our 2-minute chart, then we trade in that direction with a pre-determined stop and target.

Each target expectation averages around 7 points per trade. Results shown use Arcana as a long/short filter for reversals and secondary line breaks. Arcana may also be used as a filter for the primary trade. This gives us more trade efficiency, but overall slightly less profit. Blackjack, along with the Gann methods its based upon, is taught in its entirety in our "W. D. GANN: MASTER THE MARKETS" Training.

Below you will find the stats on Blackjack intraday applied to the SP 500 futures for the last 10 consecutive weeks since we have honed this strategy. Scroll through the gallery and expand the pictures.

Blackjack also works great on playing breakouts/downs on other markets and timeframes, especially catching the breakouts/downs during an entire trend on a daily chart of Bitcoin. In the near future, you’ll be seeing a lot more of Blackjack on this site. Blackjack, along with the Gann methods its based upon, is taught in their entirety in our "W. D. GANN: MASTER THE MARKETS" Training.

EMPIRE NEWSLETTER 2024 FORECAST

March 2024Master The Markets

April 27th, 2024 ONLINEDISCLAIMER

Futures, Equities, and Options trading/investing has large potential rewards, but also large potential risk and is not suitable for everyone. You must be aware of the risks and be willing to accept them in order to invest in the equities, futures and options markets. Do not trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures, stocks or options on the same. No representation is being made that any account will or is likely to achieve profits or losses similar to those W. D. Gann claimed or anything shown on this website. The past performance of any trading method, strategy, or technical analysis technique, system or methodology is not necessarily indicative of future results. No one associated with this seminar or Tradingwdgann.com are Registered Investment Advisors, Commodity Trading Advisors, or certified, registered, affiliated or approved in in any way with either the National Futures Association, Securities and Exchange Commission, Commodities Futures Trading Commission, or any other organization.

“Master The Markets” exegetes and replicates, as accurately as possible, the original technical analysis, strategies, and market techniques of the late W. D. Gann; and not necessarily the exact trading methods of course presenter or any other individual or entity. You may not be able to duplicate the results of W. D. Gann for many reasons, including, but not limited to, skill of the individual and the changes in financial markets since Gann wrote about them. Recipients of this course receive hypothetical, back–tested data and not actual trading results. Technical analysis, indicators, strategies, and market techniques, including any descriptions or evaluations of their performance, included in this course and displayed on this website, are described and evaluated based on hypothetical back-testing, and not the actual trades or earnings of any individual or entity. Back-tested results should never be interpreted as "typical." Includes far more applications to market instruments and time frames than the presenter can possibly implement. Author & presenter has sources of income in addition to his work with financial markets. In any and all descriptions of this course, or any information displayed on this website, no individual or entity, including past clients or course presenter, “hold themselves out” as achieving any level of success trading or amassing any level of wealth or income derived from any course offered on this website or any or all of the information displayed on this website.

“Master The Markets” teaches the individual technical analysis, market methods, strategies, and indicators we believe W. D. Gann used in financial markets, occasionally demonstrated by showing different ways Gann combined them to work together. Neither These combinations, nor anything displayed on this website or offered in any course on this website constitute a “futures trading system” or a “stock trading system.” Nothing shown or described on this website should be taken as any individual or entity claiming, inferring, or insinuating, investment advice in any way. No one associated with course or this website accurately verifies or tracks results of past clients.

CFTC RULE 4.41HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.