W. D. GANN INTRADAY TRADING STRATEGIES

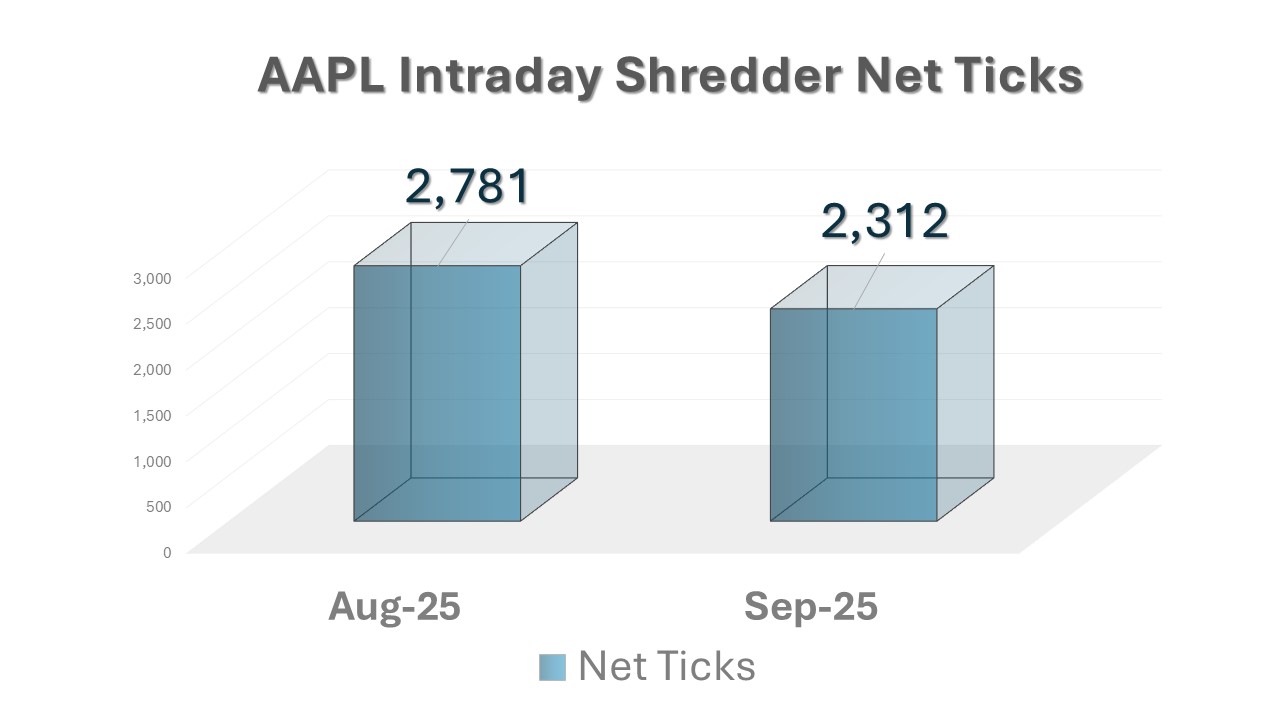

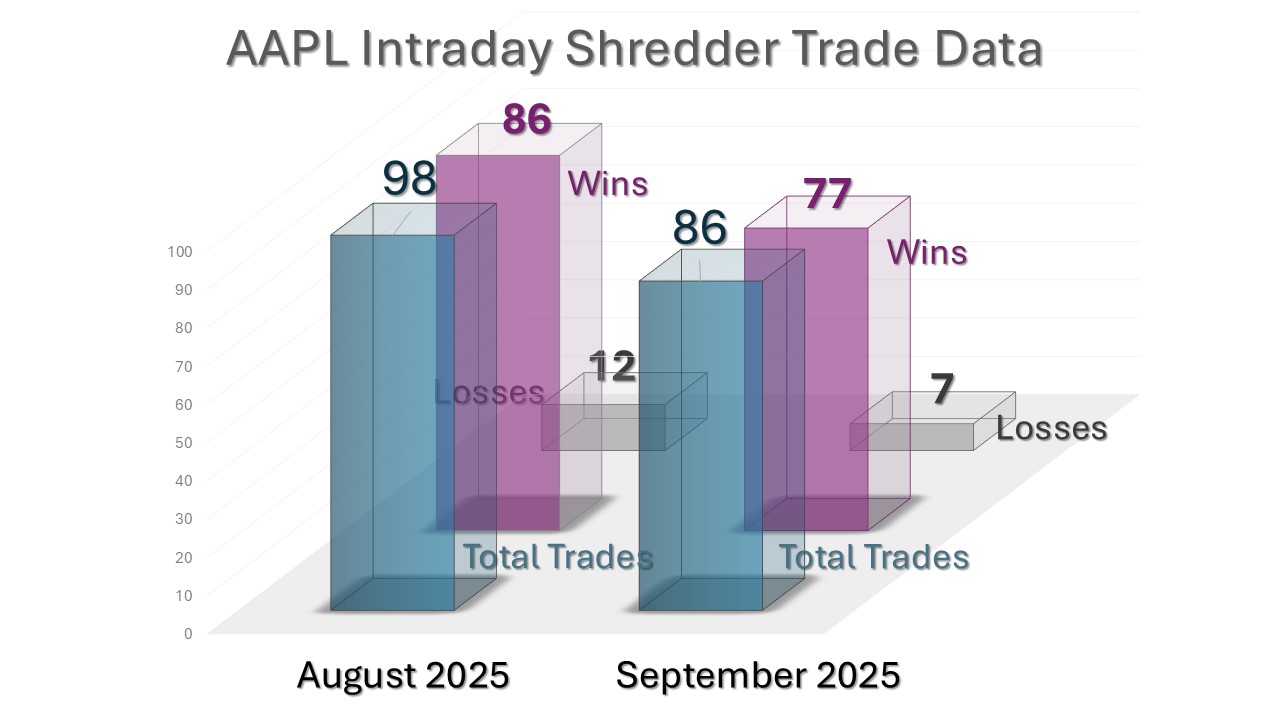

W. D. Gann claimed to have made 288 intraday trades in 1908 from a brokerage in Oklahoma. Only 20 of those trades ended in loss. Over 100 years ago Gann, pioneered intraday trading to prove his unique trading methods could be drilled down to inside of a day. Given the public angst about "day trading," it is important to note that we are not out to turn people into 'day traders.' This timeframe clearly isn't for everyone. We are aware of the statistics showing 95% of day traders lose money. This page assembles our top performing Gann intraday trading strategies. Read about the different markets and strategies below, then follow the links for each to learn more, see trade examples, and review performance stats. On legacy markets, most of these strategies are battle-tested over years. In newer markets like Bitcoin, we are still finishing up statistics that go beyond 6 months. In all of these intraday strategies you are flat by end of day. Below you will find several weeks worth of trades for Bitcoin Shredder, which uses 15-minute bars. Shredder utilizes a proprietary formula Gann wrote about in 'Truth of The Stock Tape.' This formula reduces trend prediction to a bar-by-bar basis without repainting or lagging. Gann combined this trend with price positioning and time-period (price bar) analysis for his trading rules. Upping the ante in complexity a bit, below you will find Gann's intra-week trend and cycle strategy which also integrates his "balanced entry" techniques. Moving into more complex strategies, we have spent years perfecting W. D. Gann's trend and cycle mainstay strategies on Bitcoin in both intraday and daily chart timeframes. Click here to learn more, see trade examples, and review stats. The SP 500 is blessed to have the most Gann intraday trading strategies work for it. See the descriptions below for each strategy, then follow the link to learn more about each and see trade examples. It is important to note that our SP 500 strategies are traded only in regular US equities sessions. The signals are derived from quality data of either the SP 500 Index or the ES futures, but execution can take place on SPY, ES, minis, or options. We now have 3 years pf back-testing on this bread-and-butter Gann intraday strategy on the SP 500. This method combines custom time periods, Arcana Trend prediction, and Gann's mechanical trading rules. All inside of a day. In 3 years, we have never seen a losing month on this strategy. Click here to learn more, see trade examples, and review stats. The periodic cycle method combines the trend prediction of Arcana with the up-and-down predictive rhythm of the intraday periodic cycle. if price is in the right place, the start of each cycle will trigger the trade with Gann's "points" defining the targets and stops. Click here to learn more, see trade examples, and review stats. It should also be noted that this periodic cycle on the SP 500 can be combined with the $TICK Index to generate unique and high-confidence scalping opportunities. By year's end we will have 3 years' worth of data of each trade on Unicorn over the last 3 years. We have never found a losing month. Unicorn is unique but comes right out of Gann's work with numbered squares. Each day Unicorn offers new and dynamic breakout/down levels based on Gann's mathematical formula. Included is a target, stop, and money-management with each entry. Every other call we get is now about Unicorn. This strategy is precise, and seems to work the way it does because large market-makers have ingrained it into their algorithms. The equity curve starting with a $30,000 account has produced 7 times the original account size trading with one ES contract. This mythical beast is now a reality, and you can click here to learn more, see trade examples, and review stats. Goldfinger is what we call our Gold intraday trading strategy. Goldfinger combines the intraday Arcana Trend Cycle with the Periodic Cycle for Gold. This cycle changes every day, but is generated from a fixed point using a mathematical formula before the market data. Right now, we have this strategy worked out beginning with the old COMEX pit start time of 8:20am EST in the US Session. Goldfinger also uses Gann's Arcana trend prediction in combination with the intraday periodic cycle unique to Gold each day. We are still finishing compiling the stats for Goldfinger. You can see a gallery of several weeks' worth of trades and learn more by clicking here. Click here to learn more, see trade examples, and review stats. Intraday Goldfinger, in addition to all the intraday strategies on this page, are taught in their entirety in our "W. D. Gann: Master The Markets" Training. W. D. Gann found the most liquid stock that generated the most volume, and then drill down and trade it several times a day. Examples of this are Union Pacific in 1908 and US Steel in the 1900s. Though Gann is no longer with us, today that stock is AAPL. It has the most liquidity and the tightest spread. Its massive capitalization makes moves very smooth and predictable. Most of Gann's intraday strategies perform very well on AAPL, making it a day trading favorite. We will be including a module in our 'Master The Markets' called the AAPL "Master Class." This will teach about 8 thoroughly back-tested Gann and other institutional trading strategies on AAPL. The goal will be to stay with one stock that you know like the back of your hand, and whatever move it makes that day, you will be all over with a 77%+ probability of a winning trade. Being very liquid, AAPL works great with Gann's "Shredder" strategy, this time on 2-minute bars. Shredder uses Gann's mathematical formula to predict trend bar-by-bar, giving us a 85%+ probability of estimating the outcome of the next bar. See the graphs to the right and below of Shredder on AAPL intraday for August and September of 2025. Total points and trade data. Not bad. In the next several weeks we will be updating these stats to include the whole year 2025, and add several more intraday AAPL strategies that make up our "Master Class." Coming soon to this page will also be intraday strategies on AMZN stock, Unicorn on Crude Oil and AAPL, Arcana Intraday SP 500, and a Gann grid used to trade momentum stocks such as the ones Ross Cameron trades every day. It's an exciting time to be alive and trade the markets. BITCOIN

SP 500

INTRADAY MECHANICAL METHOD

PERIODIC CYCLE METHOD

UNICORN

GOLD

AAPL

UPCOMING EVENTS...

EMPIRE NEWLSETTER 2024-25 FORECAST

March 2025Master The Markets Training

NOVEMBER 2025DISCLAIMER

Futures, Equities, and Options trading/investing has large potential rewards, but also large potential risk and is not suitable for everyone. You must be aware of the risks and be willing to accept them in order to invest in the equities, futures and options markets. Do not trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures, stocks or options on the same. No representation is being made that any account will or is likely to achieve profits or losses similar to those W. D. Gann claimed or anything shown on this website. The past performance of any trading method, strategy, or technical analysis technique, system or methodology is not necessarily indicative of future results. No one associated with this seminar or Tradingwdgann.com are Registered Investment Advisors, Commodity Trading Advisors, or certified, registered, affiliated or approved in in any way with either the National Futures Association, Securities and Exchange Commission, Commodities Futures Trading Commission, or any other organization.

The “Master The Markets” course exegetes and replicates, as accurately as possible, the original technical analysis, strategies, and market techniques of the late W. D. Gann; and not necessarily the exact trading methods of course presenter or any other individual or entity. You may not be able to duplicate the results of W. D. Gann for many reasons, including, but not limited to, skill of the individual and the changes in financial markets since Gann wrote about them. Recipients of this course receive hypothetical, back–tested data and not actual trading results. Back-tested results should never be interpreted as "typical" results. Technical analysis, indicators, strategies, and market techniques, including any descriptions or evaluations of their performance, included in this course and displayed on this website, are described and evaluated based on hypothetical back-testing, and not the actual trades or earnings of any individual or entity. Includes far more applications to market instruments and time frames than the presenter can possibly implement. Author & presenter has sources of income in addition to his work with financial markets. In any and all descriptions of this course, or any information displayed on this website, no individual or entity, including past clients or course presenter, “hold themselves out” as achieving any level of success trading or amassing any level of wealth or income derived from any course offered on this website or any or all of the information displayed on this website.

“Master The Markets” teaches the individual technical analysis, market methods, strategies, and indicators we believe W. D. Gann used in financial markets, occasionally demonstrated by showing different ways Gann combined them to work together. Neither These combinations, nor anything displayed on this website or offered in any course on this website constitute a “futures trading system” or a “stock trading system.” Nothing shown or described on this website should be taken as any individual or entity claiming, inferring, or insinuating, investment advice in any way. No one associated with course or this website accurately verifies or tracks results of past clients.

CFTC RULE 4.41HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.