SEPHARIAL & W. D. GANN

W. D. Gann shared trading formulas with the kabalas of an early 1900s Mystic named Sepharial. Born Walter Gorn Old, Sepharial, was the first to write about turning these mystical concepts of numerology and spirituality into specific usable formulas. Sepharial actually pre-dated W. D. Gann in publicly writing about how to turn mystical kabalas into market prices. “The Silver Key,” “The Law of Values," "Arcana," and " "Kabbala of Numbers," are but a few of the many books Sepharial wrote about financial astro before W. D. Gann published his 1st book. In fact, in several places in W. D. Gann’s novel “The Tunnel Thru The Air,” Gann advises us to “seek the guidance of an ‘older’ hand.” In this instance, Gann points us to Sepharial to spell out the details of his trading methods that were based in astro or numerology. Sepharial's writings are fundamental to the Gann practitioner. Many of the basics of Gann’s trading techniques can be found in in Sepharial’s “Kabala of Numbers.” (Parts I and II). All of Sepharial's trading formulas Gann use are taught in our "W. D. Gann: Master The Markets" Trading Course. See an example of Sepharial's "Secret Progression" to the right. W. D. Gann borrowed from Sepharial's orphic techniques to form the basis of his legendary forecasting. Gann published a newsletter named "The Supply & Demand Letter" in which he published his annual forecast on the US equity markets. This forecast is based on Sepharial's techniques. Quite simply, a Kabala is an arrangement of numbers according to a formula. Each number represents a specific concept. The numbers are then arranged in such a way then where they can serve specific functions, such as finding a lost article, picking lottery numbers, or predicting the market value of a commodity or stock. Sepharial even had a subscription service where the elite of England could receive his predicted winning lottery numbers. The key would be finding or knowing what each number represents in the field in which you are using it. We believe that both Sepharial and Gann had this foundational information passed down to them. Our new Gann Center is located directly on River Road just seconds from Chicago's O'Hare International Airport in the heart of all major hotels and restaurants in Chicago's Rosemont Entertainment District.

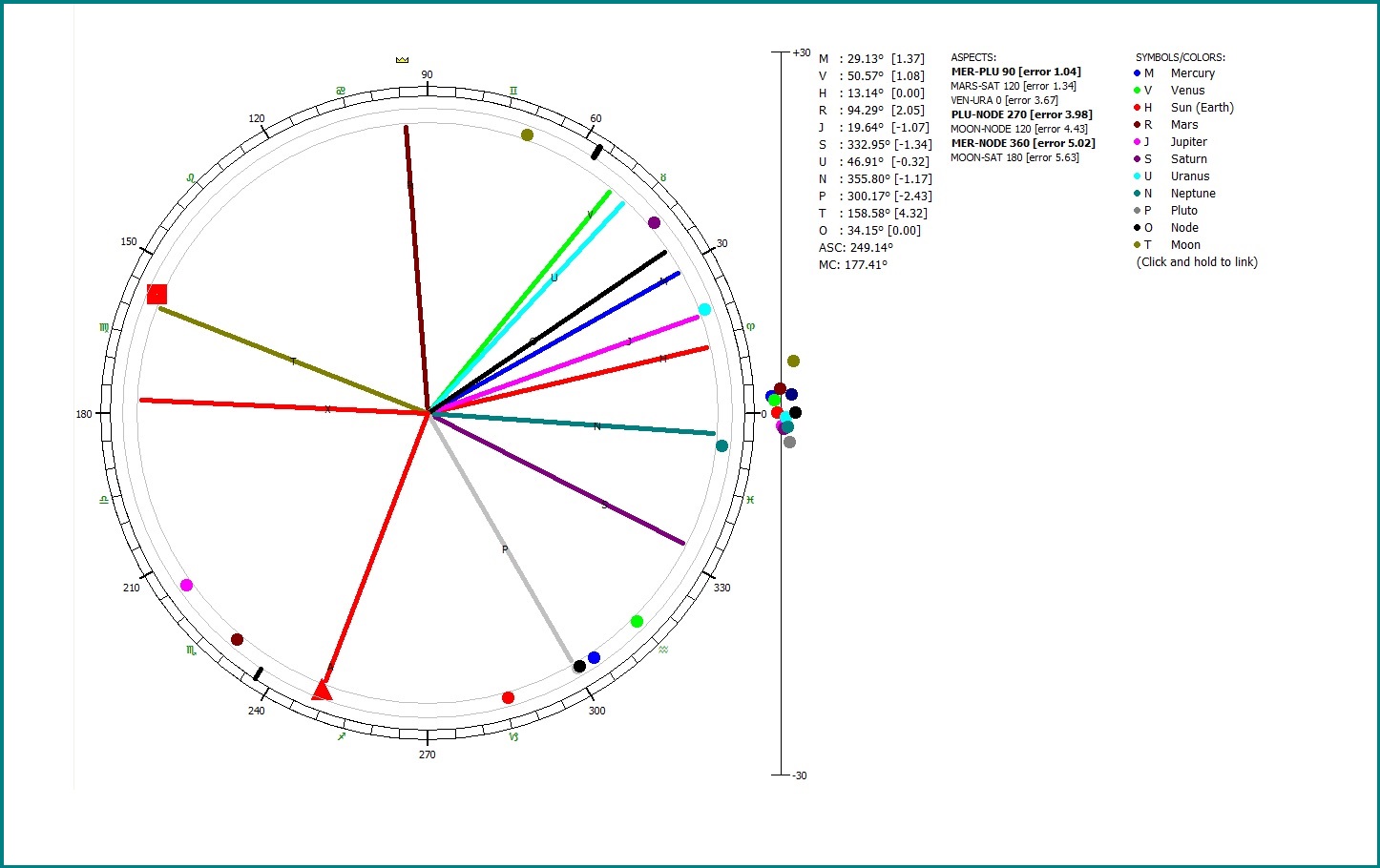

![]()