OUR W. D. GANN ANNUAL FORECASTS

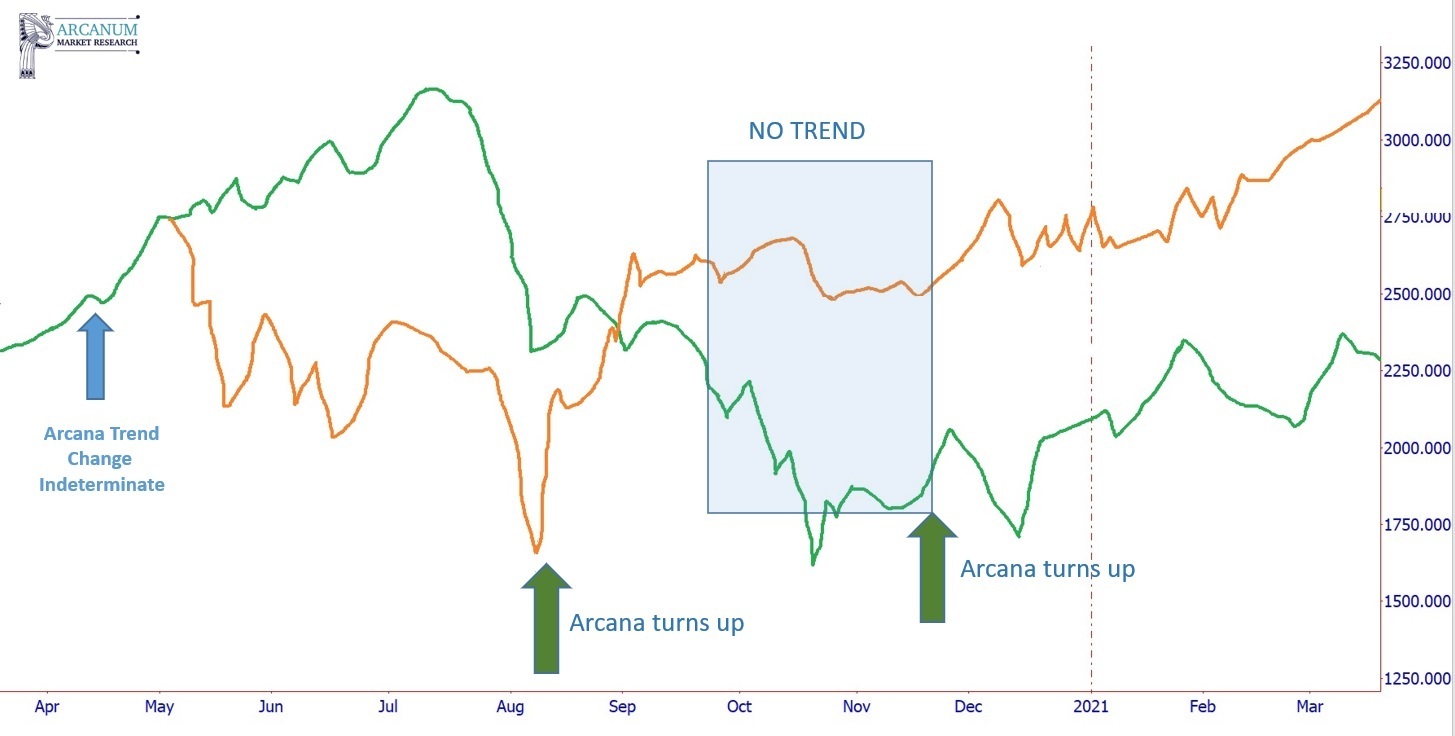

Just as W. D. Gann released an annual forecast for US equities each year in his “Supply & Demand" Newsletter, our annual forecasts are based on the unpublished forecasting method of this legendary trader. Scroll down the page for a review our annual W. D. Gann annual forecasts from the last few years and a description of the methods we employ. Just the way Gann produced his original forecasts, our forecasting blends Gann’s “Curve #1” and “Curve #2” techniques with the trend direction and duration prediction of the Arcana. Besides the overall direction and curve of the market for each year, we can then get specific enough to predict isolated times when the market would trend, stop, chop, top, and bottom. Our W. D. Gann annual forecast is released each year before the year’s market activity in our “Empire” Newsletter. “Empire” blends Gann's unique method of forecasting the annual pattern of the market for the upcoming year with technical analysis of the US Equity Indexes. We then add economic, fundamental, and other relevant proprietary analysis by a CMT to give each year’s forecast and market segment a confidence level. Rounding off the forecast is a list of market picks including sectors, individual issues, commodities, weighting, and hedging suggestions including intermarket analysis. The W. D. Gann forecast below was released in March 2020, and forecast the upcoming year from March 21st, 2020 through March 21st, 2021. "Arcana" trend duration and direction predictions, turn times, and polarity line trades compliment the forecast to provide detailed action points. The forecast started by accurately predicting the market run up from late March to May. The forecast for 2020 was another instance where W. D. Gann's Curve #1 (green line above) and Curve #2 (orange line above) did not completely match. Gann illustrated these curves separately in his 1929 "Supply & Demand" Newsletter. By March 21st, we have confidence the market is bouncing into April 8th. Both curves agree up to that point. Then they fork- human choice will take us on one road. By May 5th, we are certain we are on the high road following the green line curve. The market will then continue to follow the green line until March 2021. The market did as forecast, soaring into the end of July on the green line. At that time we recommended all positions relating to US Indexes underweight or flat (if possible) due to the forecasted decline into the August 7th bottom/UP Arcana. That decline failed to materialize and instead paused. Then we forecast an UP trend again starting from August 7th and lasting through the end of September. Then there was a "no trend void" starting late September and running through the end of November. During this time, the market could do "as it pleased." These times can be characterized by higher volatility and sudden moves. The we forecast another up-turn November 28th through the end of what we can display above, with 15% rise possible. Again the market neatly complied.

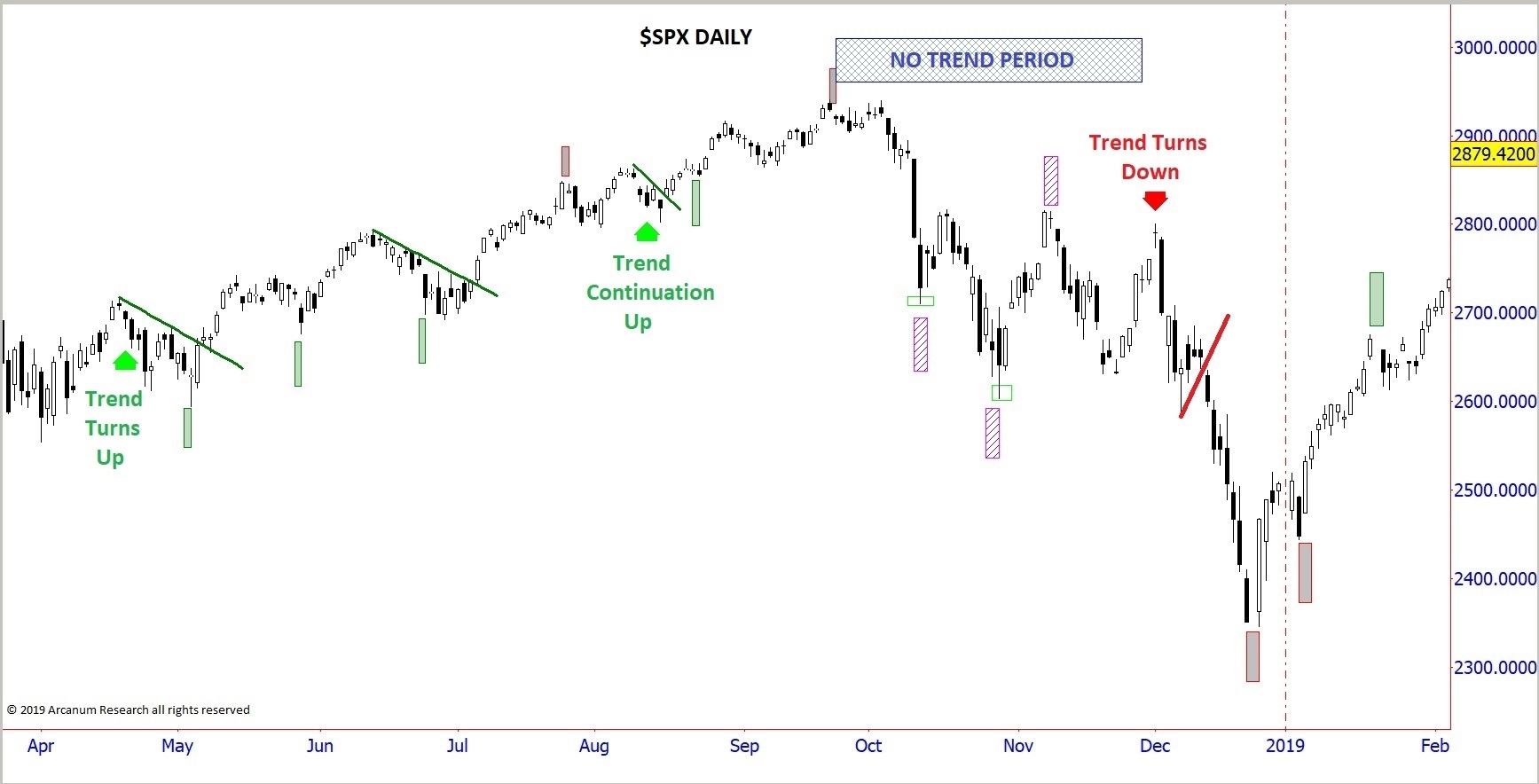

2020 has been an accurate forecast, especially taking into account an indeterminate Arcana to start and Curve #1 and Curve #2 disagreeing. 2020 is a perfect example of how W. D. Gann interacted with his subscribers regarding a difficult forecast. He would focus on taking action during the points most certain and advise caution during those times that were inharmonious or vague. Our 2019 Empire newsletter was released in February 2019, prior to that year's market action. The forecast predicted the annual movement of the US Indices for March 21st, 2019 through March 21st, 2020. Though the pitch of the actual 2019 data is distorted by the cataclysm at year's end, as you can see the forecast below was dead-on for 2019, minus the apocalypse at the end. See below for explanation. In the picture above, the 2019 W. D. Gann Annual Forecast Line is top, and actual SP 500 data on bottom. 2019 again posed a split in W. D. Gann's "Curve #1" and "Curve #2." The split comes where the blue line appears. This split denotes that human choice will make the market follow one of two paths for the year. Until then, the forecast is united. At the time of the split, we advised "out all annual positions." Early on around May 2nd, the prediction in advance for both the forecast line and Arcana: a strong down. Shown the following plate, a Minor Arcana entry (pale green pillar, trend resumes) signals entry soon after. The short went against the secular uptrend though, and we near hit the bottom of that move to the day. Then a big bounce up against the down-energy of the Arcana. Then a brief Arcana trend down mid-August, also fighting the secular uptrend. This mini-trend spans until September 23rd, then the "no trade zone" until the end of November. This small trend was not long enough to trade, and the message to our clients at this point: "out all annual positions" until the market confirmed the higher line in October. Then the market pokes higher than our projected double-top at this second shallow downturn, but the forecast got the pattern right. At this point we knew and advised the market would break to new highs at year's end and on through the end of the 1st quarter 2020. The upper forecast line forecast that the strong secular uptrend would blow-off high and rip right through the November 22nd Down Trend Arcana. So we had a clue the market would correct given the down energy. What followed was a surprise to us and many. Looks like it is difficult to fool mother nature, as the Down-Arcana through March 21st won. In the ABOVE 2019 full forecast, the big red arrows are the start of Arcana trend predictions. All down. The first Arcana Trend on May 2nd runs through the beginning of the second Arcana Trend mid-August. Then the next down trend lasts through September 23rd, where the grey "trend void" box starts. In this box, the market is forecasted to do its own thing. Then on November 22nd, the next Arcana is down, at which point the market blows through to new highs. The pale green pillars are minor Arcana times, marking times to enter in trend direction. The gray pillars mark ends of runs in trend direction. Our 2018 Empire forecast is featured in the first chart below via the forecast line. Keep in mind that this letter is issued in January, so we have to assume a start-price for the March 21st. forecast start at that time. The second chart below lacks the forecast line, but adds the specific entry points against the trend, polarity line entries on moves against the trend, Law of Vibration extreme price projection entries, and money management on entries. All W. D. Gann forecasting techniques. The above chart forecasts the general curve of the market with the forecast line. This forecasting line is drawn and we publish it before March 21st of 2018. Once the forecast is made, it remains unchanged. The green and red arrows show when the Arcana trend forecast turns up or down. These points are forecast more than 1 year in advance, and we also publish them before March 2st, 2018. The forecast curve and general direction turn out accurate for the year. The Arcana trend directions and durations strike us as uncannily accurate, as they are every year. Note the “trend void" September 23rd through December 2nd when the market went crazy. Our opinion is that the bizarre drops of 2015 and 2018 where the market moved against the predicted trend seem to be ploys by those in control of the markets. They want to send the FED a message. That message? Raise rates, here is what will happen to you! And the FED listens both times. In both years the market snaps right back up to the forecast. See below for actual $SPX for the year. We have removed the forecast line and added the actual trades, minor Arcana entry points resuming the trend, and some basic technical analysis. In the above charts, the forecast line is out of the picture so you get a clear vision of what is happening. Included are the “Minor Arcana” turn times, which are entry points on moves against the trend (pale green pillars.) The red/gray pillars are Minor Arcana ends of runs in the direction of the trend, good for taking positions off the table. The light green boxes (2 of them) in October are the extreme price buy entries W. D. Gann’s Law of Vibration project. This year presented 4 trades and 1 short entry signal in December we chose to omit from trading. Enormous volatility here. In the first trade, “A” in April, the Arcana trend forecast turns up in conjunction with the forecast curve. An aggressive at the green pillar looks good, or conservatively waiting for the market to break above the downtrend line seems safer. In trade “B,” the same choice presents between aggressive Minor Arcana entry and trendline break. Then on September 23rd the trend stops. After 2 great trades like that, we advise “out all positions” during trend voids. “Red Alert” out at October 3rd with a red/gray top of run turn time and our “Top & Bottom Finder” signaling a definite top. In the "trend void" between September 23rd and December 2nd, we will look for polarity line breakouts or breakdowns. The polarity lines actually flash a “too volatile” signal here during this entire time. But on October 11th a Law of Vibration price projection from the top signal and “extreme buy price” in the first light green box at 2712 sets up. This is to be our 3rd trade long with a 100+ point gain. Then another extreme price is hit at 2612. Our fourth trade. Again another 100+ point bounce. Finally, the forecast for a December 2nd Arcana down-turn was dead on. The market takes off south, pausing and pulling back, then resumes down. Entry signals on a simple trendline break by the red trendline being broken. Even though this looks like a killer trade, we advise against it because of excessive volatility. After 4 great trades and 400+ points if these signals, why risk? After all, prices were still above an up-sloping 50-month moving average. Email us at empire@tradingqwdgann.com or call 312-532-2116 to signal your interest in Empire. VIEW OUTLINE & SCHEDULE. "Magic In The Markets" includes:

2020 W. D. GANN ANNUAL FORECAST UPDATE

2019 W. D. GANN ANNUAL FORECAST UPDATE

2018 EMPIRE EDITION & EXPLANATION