W. D. GANN POLARITY LINES

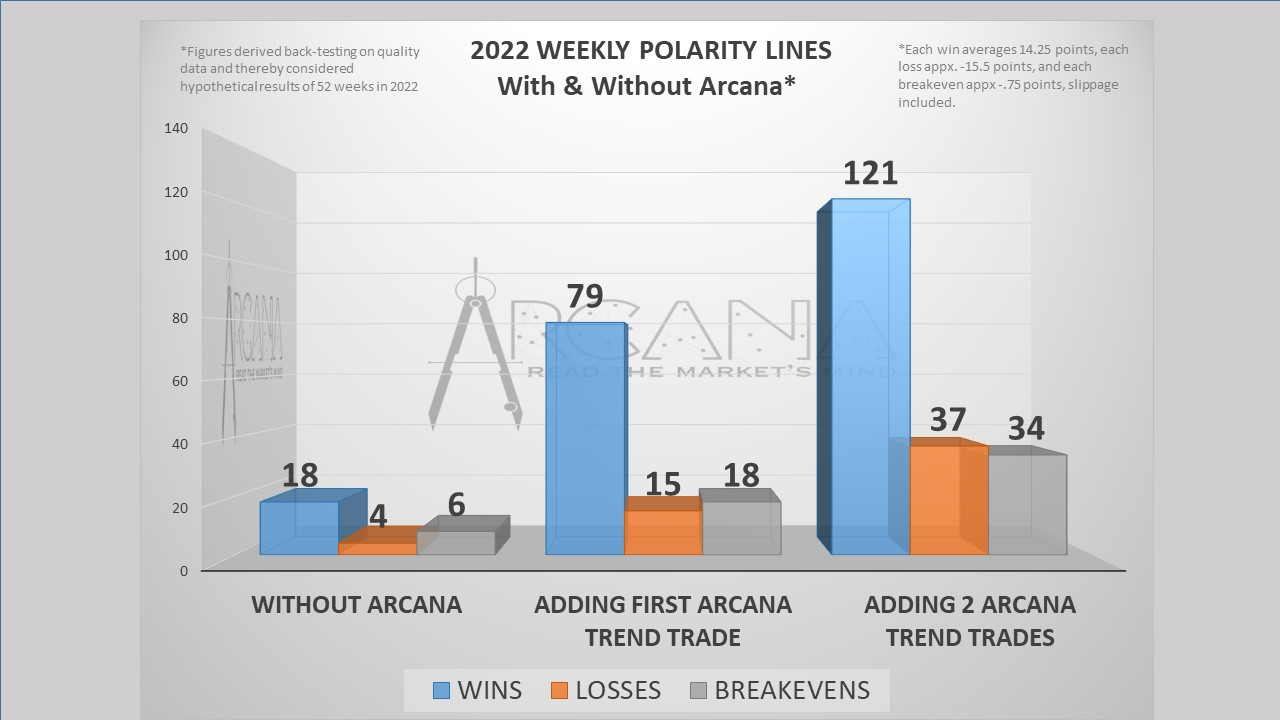

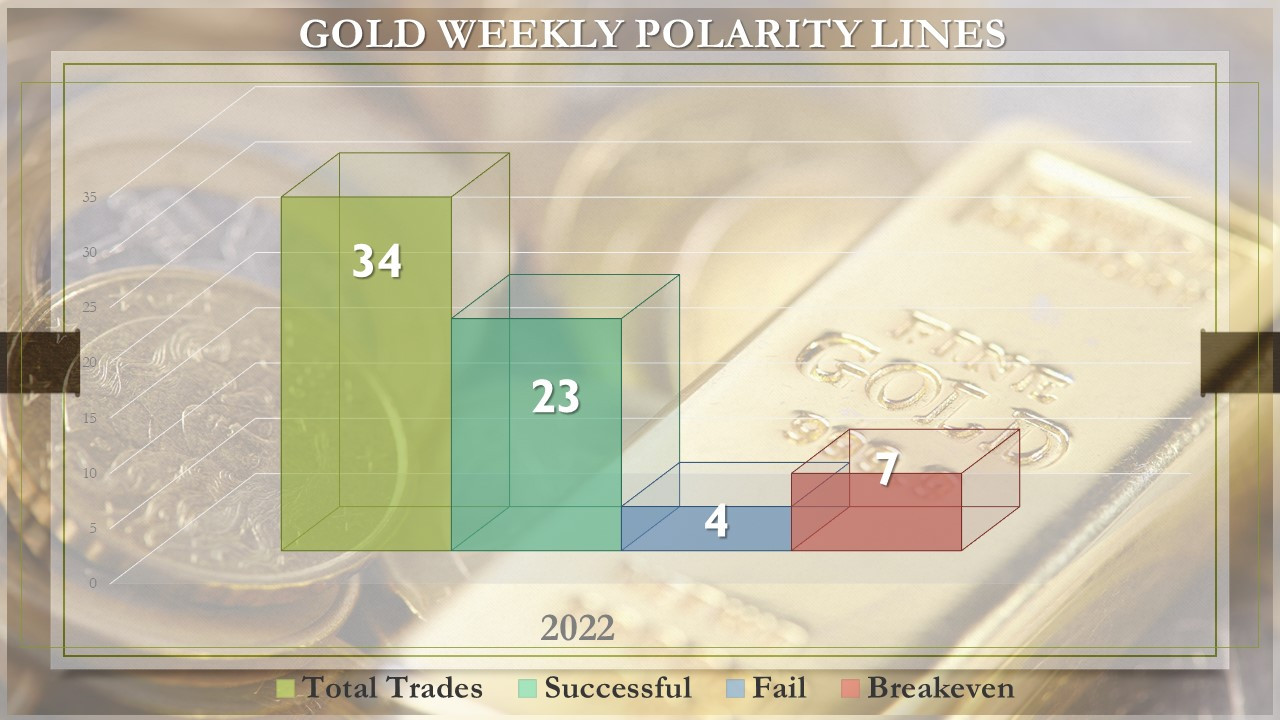

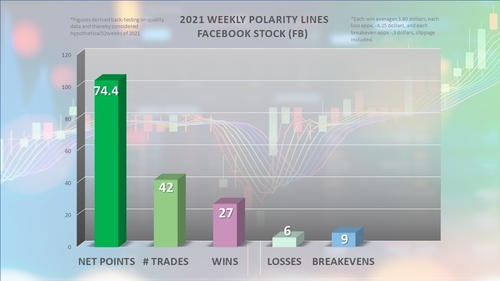

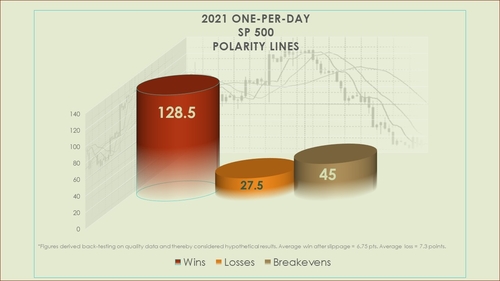

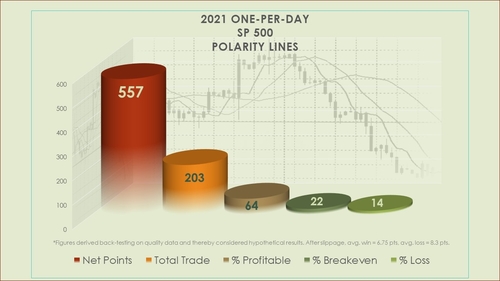

Have you ever seen markets run up or down into an invisible wall? You try in vain to explain the invisible anomaly with a pivot point, moving average, or price support. And once price breaks through, it explodes like a rocket. Chances are You have encountered a “polarity line,” or one of W. D. Gann’s “resistance lines.” The catch- these lines are only visible to the Gann trader. These lines represent hidden forces behind-the-scenes of the market. If a market has enough energy to close above or below a polarity line on the timeframe you are trading, the polarity propels price a predetermined distance. Gann advised simple, objective rules for trading these lines alone or with his other techniques. The placement of each line in advance changes each day, week, month, or year according to a predetermined formula. It is possible to draw lines are drawn YEARS in advance, even for intraday analysis. Trading these lines are ranked according to "best of breed" in our "W. D. GANN: MASTER THE MARKETS" Training. Gann combined Polarity Lines with other Gann techniques and conventional technical analysis. The sky is the limit on their application, because they capture a sound premise causing breakouts. The graph to the right shows Facebook stock's weekly Polarity Line trades for all of 2021 using only the simple first break of the nearest line each week. A preschooler can do this. Of the 52 weeks there are 42 trades, 27 wins, 6 losses, 9 break-evens, and a net $74.40 points. Do you know of any quant programs that can do that? Using only the break of a drawn line? Last year FB printed over $75 dollars net up using just these line breaks. Over the last 4 years it usually does about $39 minimum. Let's up the ante a bit. In the graph below for the Weekly Polarity Lines on the SP 500, we have added the Arcana, or W. D. Gann's trend prediction technique as a directional trade filter. The graph breaks down the trading 3 ways: (1) Only taking the first break of the nearest line to price limited to one trade per week; (2) Dividing the week into zones based on Arcana trends or trendless zones, and taking only the first line break of each zone only in the direction of Arcana trend; and (3) Same as #2 above but taking only the first 2 line breaks in each trend zone. Gann offered options like these to his students based on their appetite for complexity. Note that each "win" in the graph represents 14.25 points on the SP 500 after slippage applied to diminish each win and exaggerate each loss and breakeven. By taking only one line break alone per week, these Polarity Lines have yielded between 90 and 220 points each year on the weekly SP 500 for the past 6 years, but as you can see they are far more potent adding Gann's Arcana as a trade filter. Of course, these lines also work on an intraday basis. Slippage is more of a factor on intraday markets using these lines. The key is to find a very liquid and active market to compensate, usually a stock. Click on the graphs below to see expanded results and test criteria on intraday performance on the SP 500. Scroll through the gallery below for gold weekly futures polarity lines. This technique and data set is confined to New York equities session. Only 3 losses in all of 2021! Each target and stop is approximately $10. Executable on GLD etf and options as well as futures. Contact us for more information about the above techniques, or if you would like stats on the market and timeframe you trade.

FACEBOOK WEEKLY POLARITY LINES

SP 500 INDEX & ES FUTURES WEEKLY POLARITY LINES

SP 500 INDEX & ES FUTURES WEEKLY POLARITY LINES

GOLD FUTURES WEEKLY POLARITY LINES