W. D. GANN CYCLES FORECASTING HIGHS AND LOWS

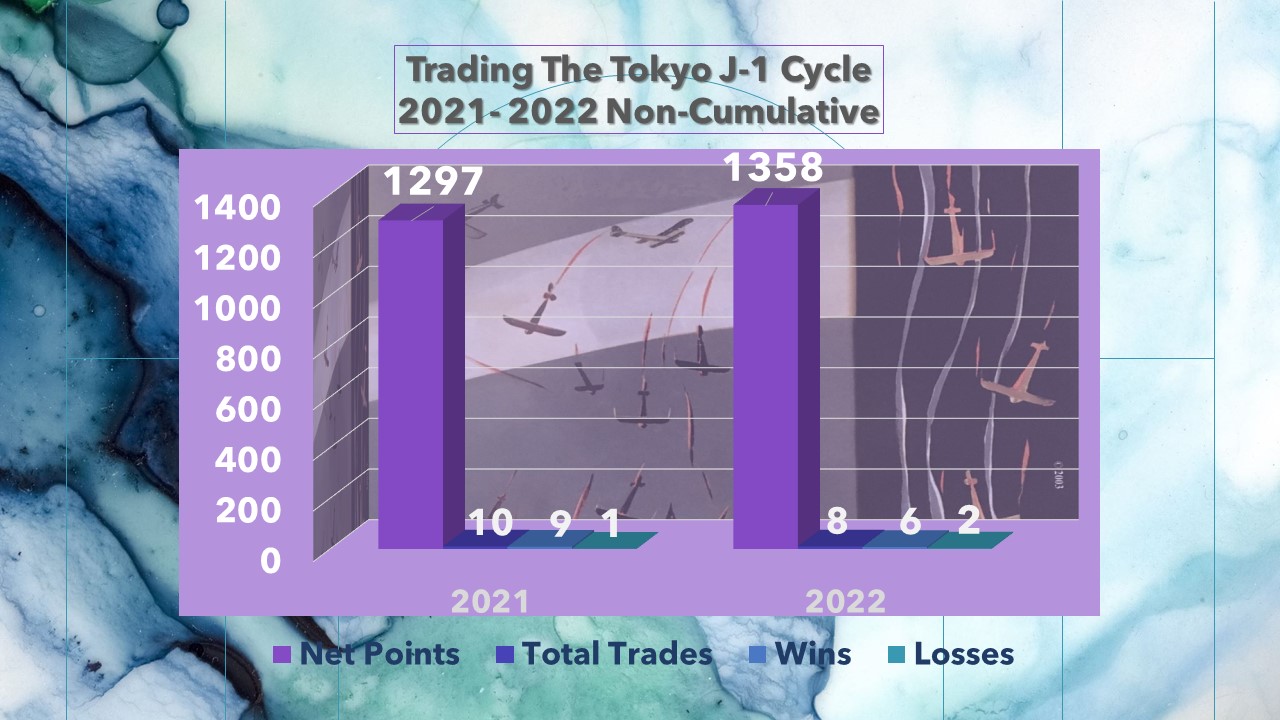

Renown cycle trader W. D. Gann used several types of cycles in his trading and analysis. In his writings, Gann uses 'cycle' to refer to up-and-down market legs, trend changes, regular periodic cycles, return cycles, and volume exhaustion cycles. Each has their own specific market application, and each behaves in a different manner. W. D. Gann's "up & down" alternating cycles from 'The Tunnel Thru The Air get the most press as the "unicorns" or Holy Grails of cycles. This page was created to explain and showcase Gann's alternating cycle technique, using Gann's Law Of Vibration. Scroll down the page to see these cycles mapped out. First, let's be clear- Gann discovered two types of alternating (up/down) cycles. The first is "Cycles of Repetition," and the second is called "Cycles of Progression." These Cycles of Progression are included and taught in our "W. D. GANN: MASTER THE MARKETS" Training, because Gann described them as superior. Cycles of Progression alternate in legs that sequentially go up-down-up-down, etc. UP always follows DOWN, and DOWN always follows UP. The green-colored cycle lengths in the examples below are 'up' cycle legs, and the red denote 'down' legs. After the cycle turns up, there should be a move of magnitude to the upside and the cycle leg should finish higher or even in price than when it began. After the cycle turns down, the opposite is predicted to be true. The cycles rarely mark the exact high or low of the period. Equally as important as knowing the proper cycle technique is understanding Gann's trading rules for each cycle. Gann called these "methods of operation." Click the graph to the right for trading results from only 1 operational method of trading the J-1. Per Gann's directions, we simply combined the cycles with Arcana long/short trend filters and used a 1.5/1 reward risk of the last pivot. When you have an accurate Cycle of Progression, the sequential alternation of the cycle lengths remains constant, even when a cycle leg fails our test. The alternating sequence of the cycle remains the same despite a price failure in the previous leg. If this condition does not exist, the prediction value for futures legs of the cycles is worthless. Our back-testing shows true "up/down" RG7 (Tokyo J-1) and Annual Cycles of Progression have a consistent success rate for the direction and duration of cycles legs over 84 - 93%. On the next page are examples of Intra-month lunar cycles. DISCLAIMER: Our legal counsel forbids us from posting future predictions. All charts copyright Arcanum Market Research, all rights reserved. Below you will find over 9 years of the “RG7,” or "Tokyo J-1," and Annual Cycles (Gann's 'Annulifier') for the last few years. W. D. Gann described construction of the RG7/Tokyo J-1 and "Angel of Mercy" cycle in the “Robert Gordon’s 7 Days” chapter in “The Tunnel Thru The Air.” He alludes to it in a period of retrograde in the war narratives as the "Tokyo-J-1" airship. It is a bigger cycle. Scroll through the gallery below to get from 2015 to 2024. All the cycles below were drawn out in advance from an objective formula. The 2022 Annual Cycle on the SP 500 is complete. So far 84% of the cycle legs, predicted in advance, are successful! Gann dubbed this annual cycle the 'Annulifier' in 'TheTunnel Thru The Air.'

INTRA-MONTH LUNAR CYCLE PAGE

W. D. GANN'S RG7 CYCLE (Tokyo J-1)

2023 ANNULIFIER ANNUAL CYCLE

2022 ANNULIFIER ANNUAL CYCLE

The 2022 Annual Cycle on the SP 500 is complete. So far 84% of the cycle legs, predicted in advance, are successful! Gann dubbed this annual cycle the 'Annulifier' in Tunnel Thru The Air.

2021 ANNUAL ALTERNATING CYCLES

The 2021 annual W. D. Gann cycle is now complete. 92% of the cycle legs succeeded in predicting direction and duration ahead of the market.

2020 ANNUAL ALTERNATING CYCLES

The 2020 annual W. D. Gann cycle is now complete. 92% of the cycle legs succeeded in predicting direction and duration ahead of the market. The cycle also endured the bounce from the most volatile time in US Index history.

2019 ANNUAL ALTERNATING CYCLES

The 2019 annual W. D. Gann cycle is now complete. Not bad, 89% of the cycle legs succeeded in predicting direction and duration ahead of the market. The cycle also held up pretty well during the black swan.

2018 & 2017 ANNUAL ALTERNATING CYCLES

The 2018 annual W. D. Gann cycle is now complete. Of note was the "message to the Fed" pattern that began October 3rdish. This was the same "fall for no apparent reason" that we ran into in August 2015. Same environment- the FED threatening to raise and the market yelling at them, "Don't you dare or we'll do this!" Suring this pattern the annual cycles saw the failure of two legs in a row. Very rare, but it denotes market manipulation against natural law. Once again, 89% of the cycle legs succeeded in predicting direction and duration ahead of the market.