The COVID-19 Black Swan has become an unprecedented event for global markets. How have the methods of W. D. Gann held up? We don’t do this often….but below we’ve copied you in on our downrange price targets/bounce prices that went out to “Magic In The Markets” alumn and Empire Newsletter subscribers in advance of the market legs in this down move.

Since November 22nd, 2019, the Arcana has been forecasting down energy into March. But the forecast was up. A blow off high identified with the potential to return to the SP 500 price on November 22nd, 2019. But no one could have predicted the severity of the slide.

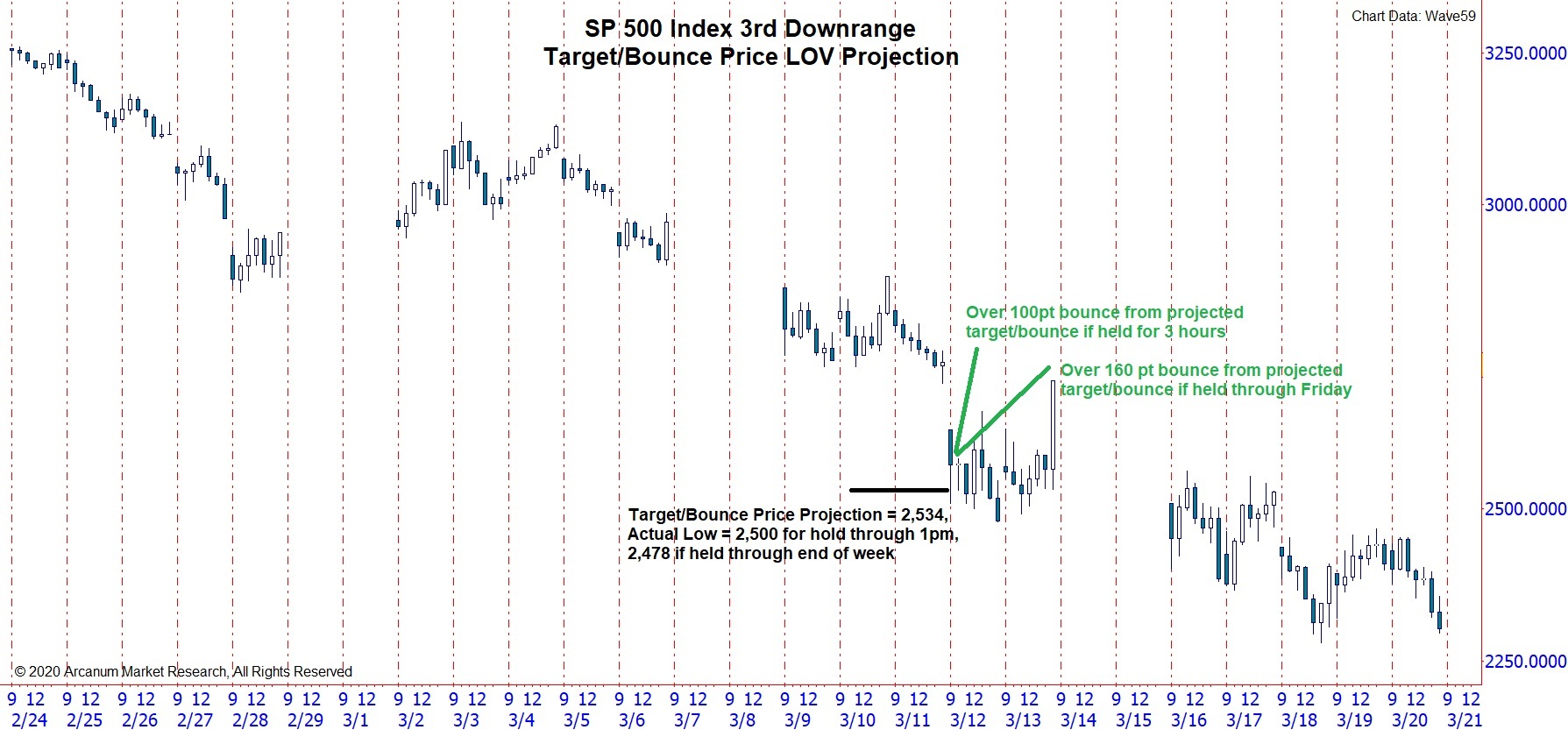

So with a down energy and a technical uptrend in the market, its a mixed bag. Targets on the way down were exits for shorts and buys for quick 100+ point bounces.

From a strong technical uptrend, usually each year you will only get 1 or 2 extreme Law Of Vibration pullback price projections to buy. After the price breaks through the 50 month moving average or 20%+ from the high, the bounce buying energy dries up, and you start to look for the absolute bottom.

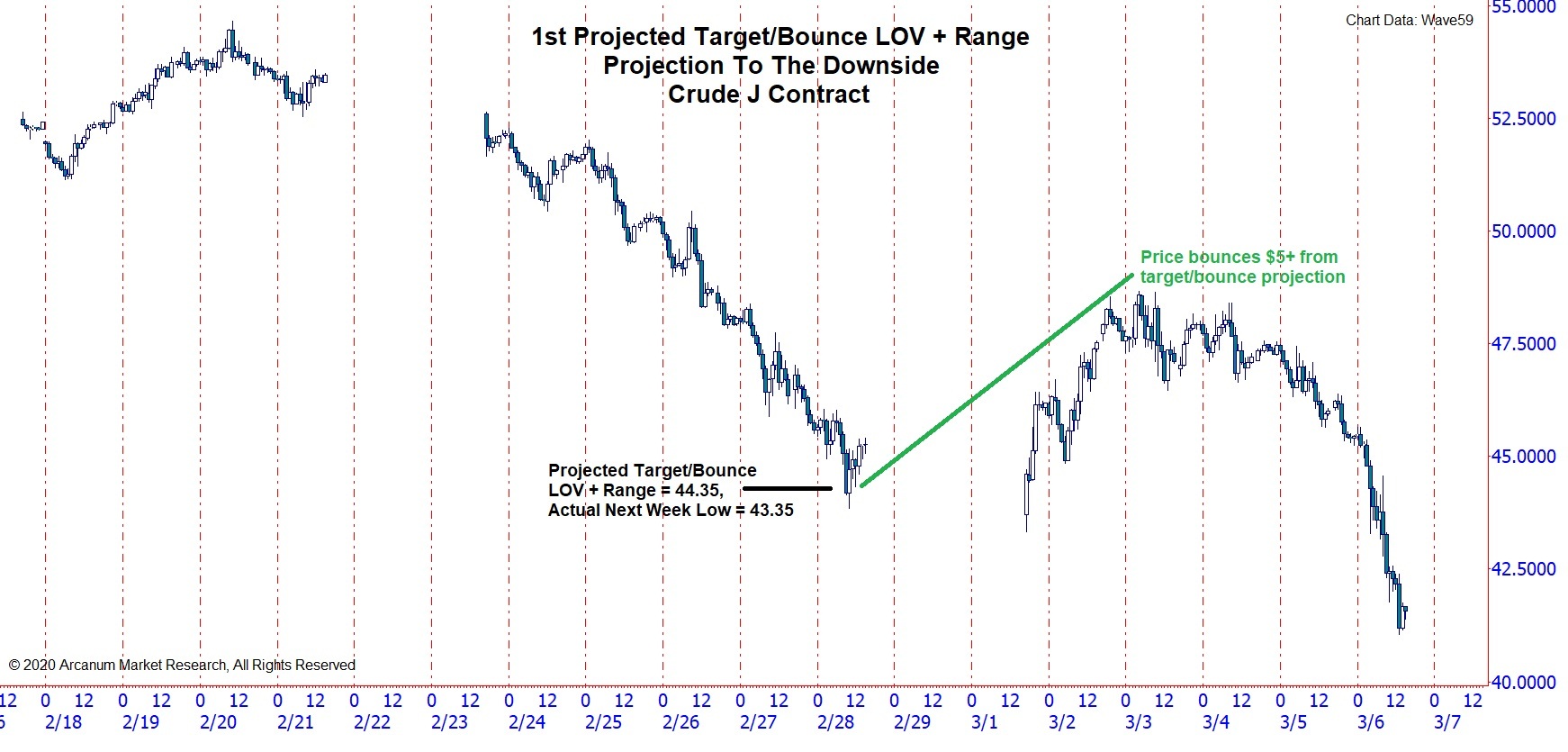

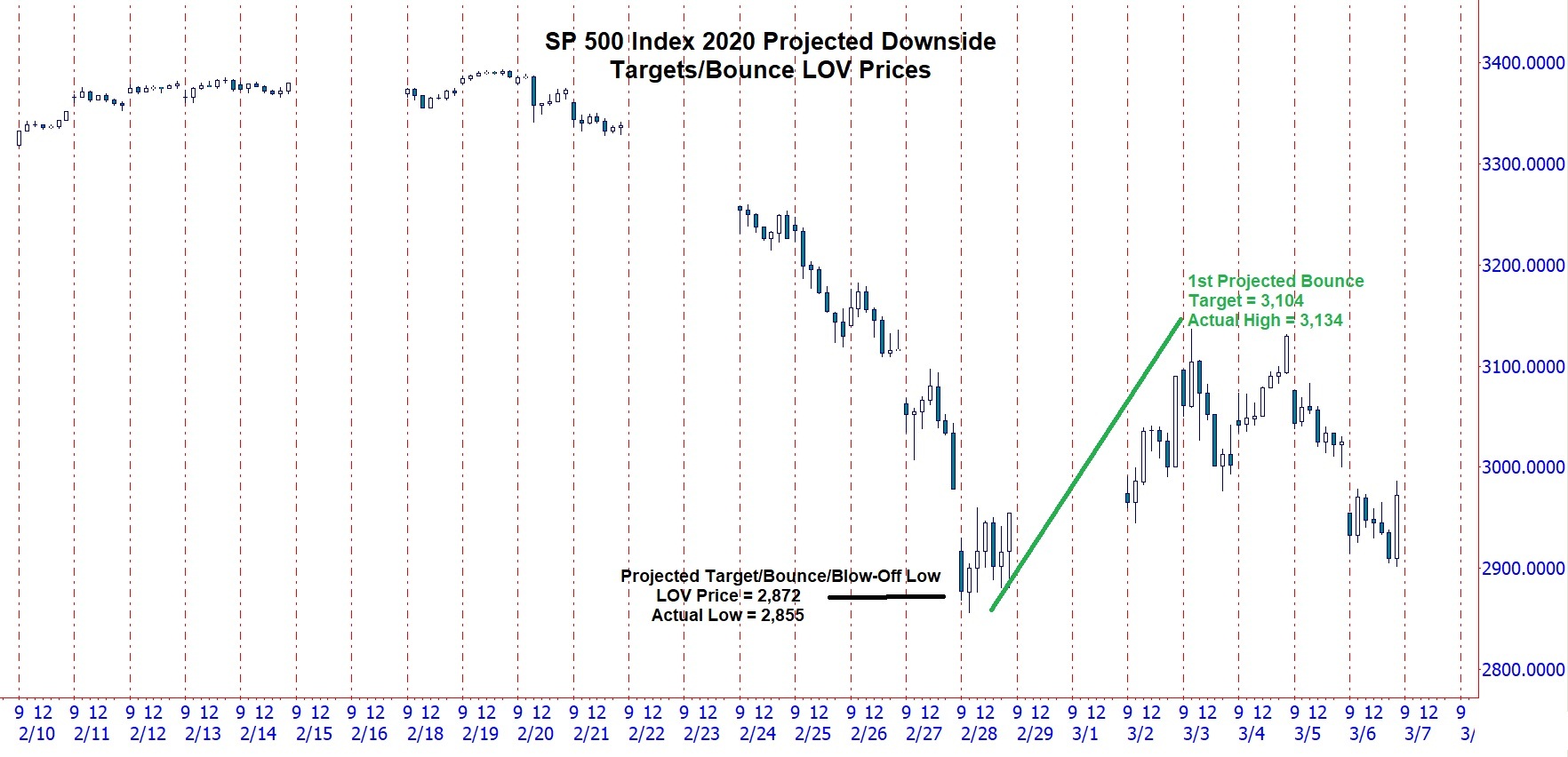

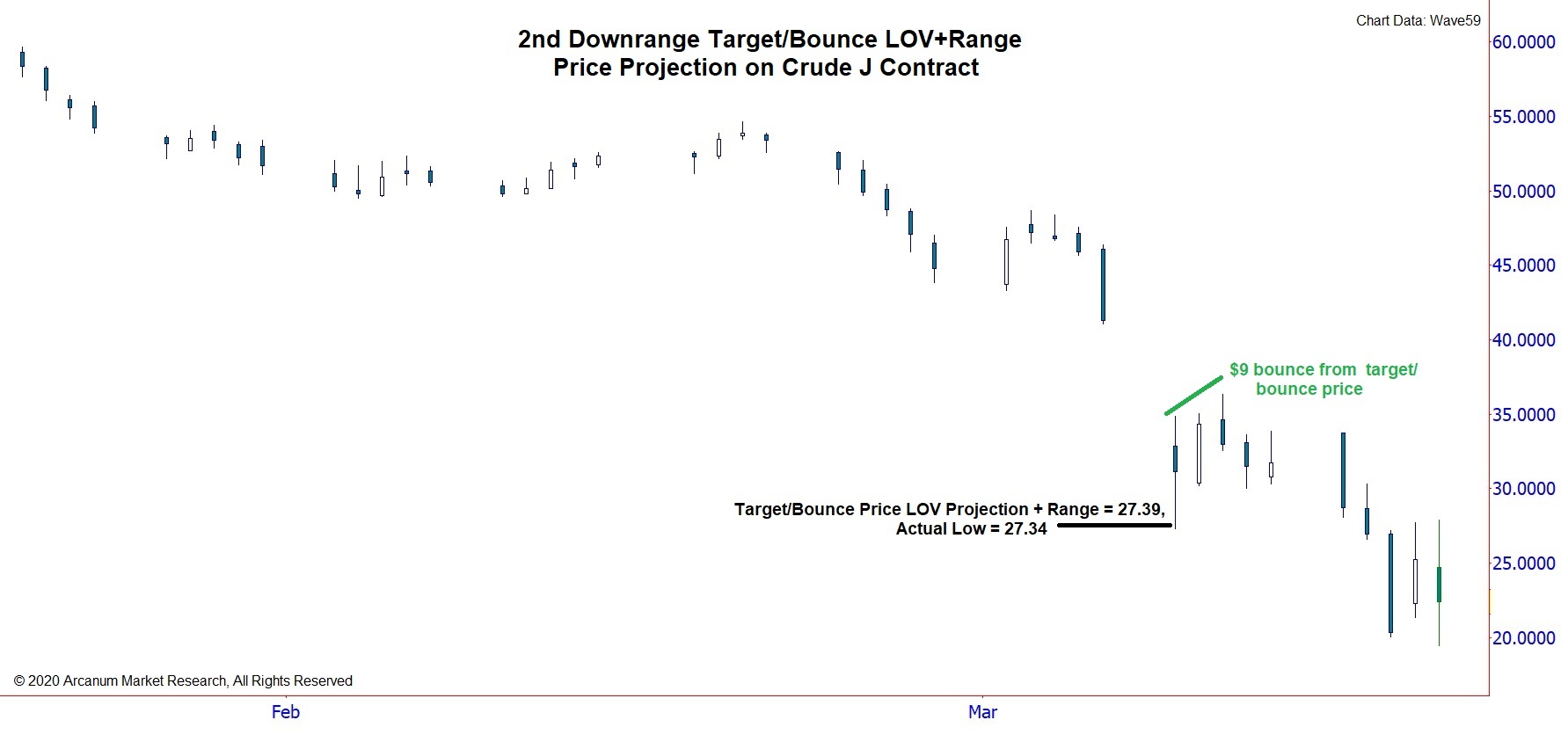

For added confidence, we combine Gann’s Law of Vibration extreme price projections with Gann’s Range Finder. Of course we also use Fibonacci and some other technical tools. On February 27th, we reiterated the first extreme LOV price projection was 2,981. After we hit it on a day’s close (Gann’s sign it would not bounce,) we knew the next projection was the blow off low price of 2,872. There was also the first crude low and bounce projected. The following day they both popped. As an FYI- updates with ongoing value for our subscribers and details on the Gann techniques used are blacked out for proprietary reasons.

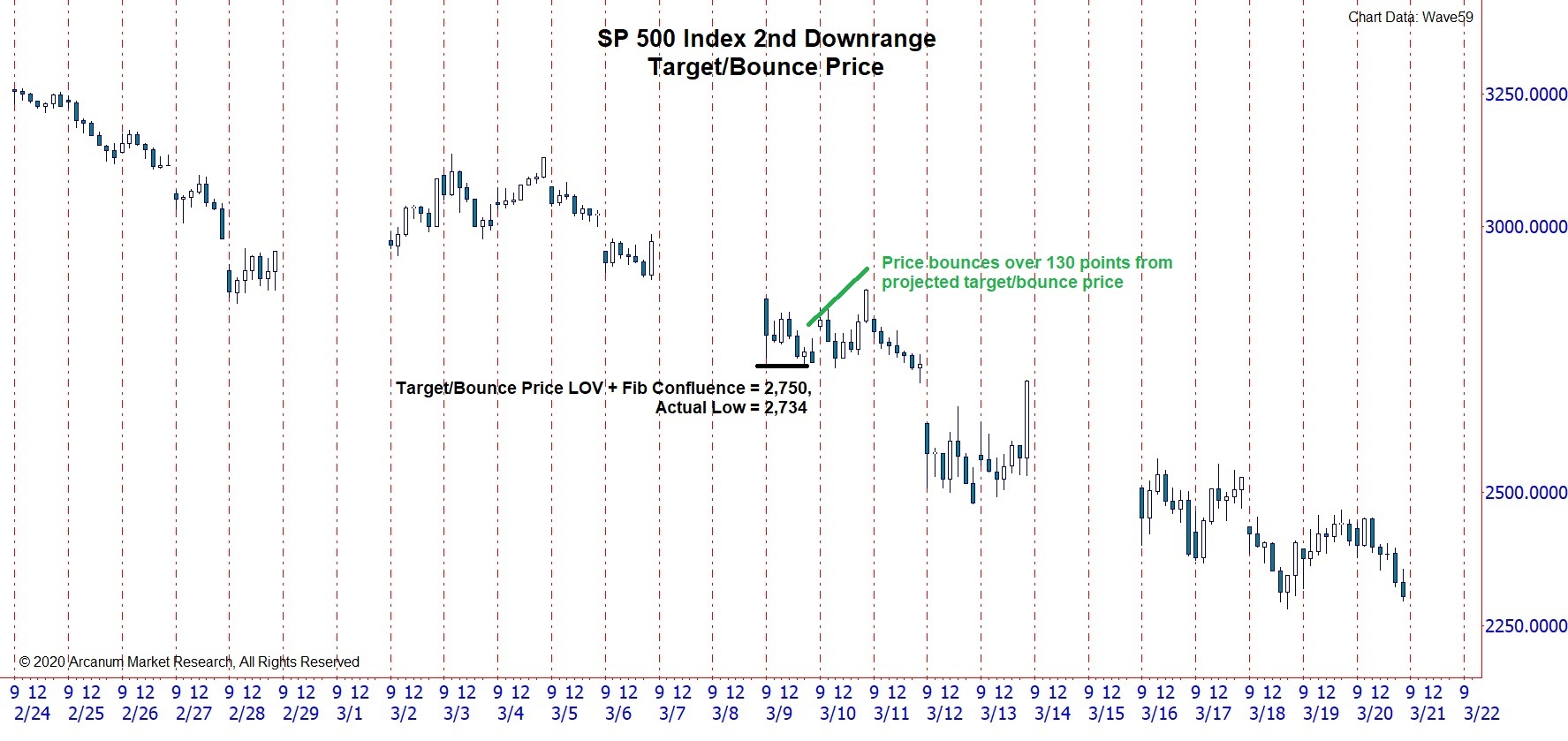

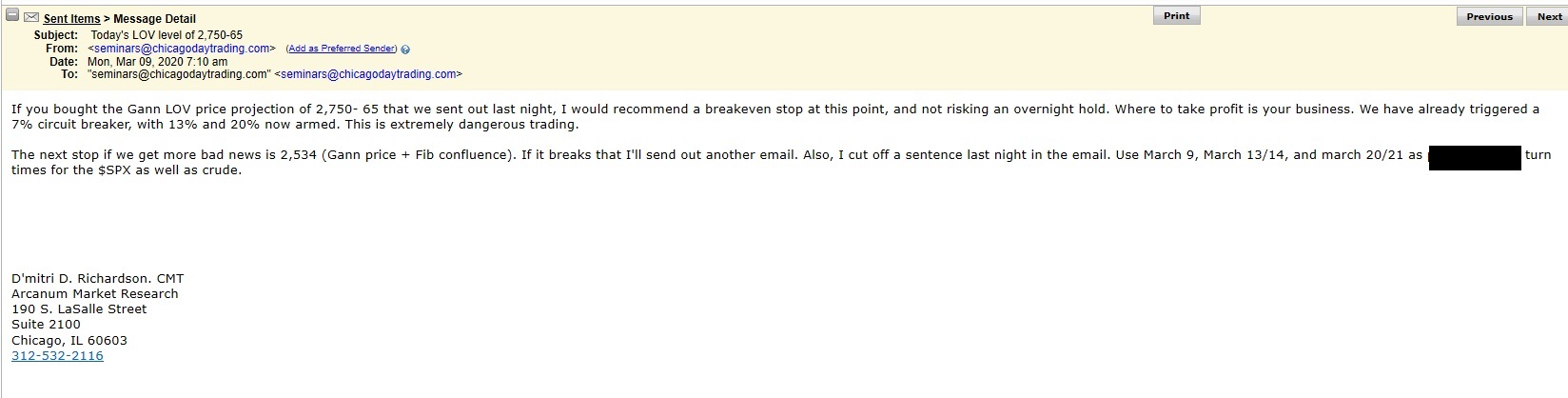

Next below: On March 8th we gave out the downrange targets/bounce prices for the next leg down.

Well those worked nicely. Below, we issue an update on trade management for the last bounce price, as a technical uptrend still exists. And the next low down/bounce is forecast.

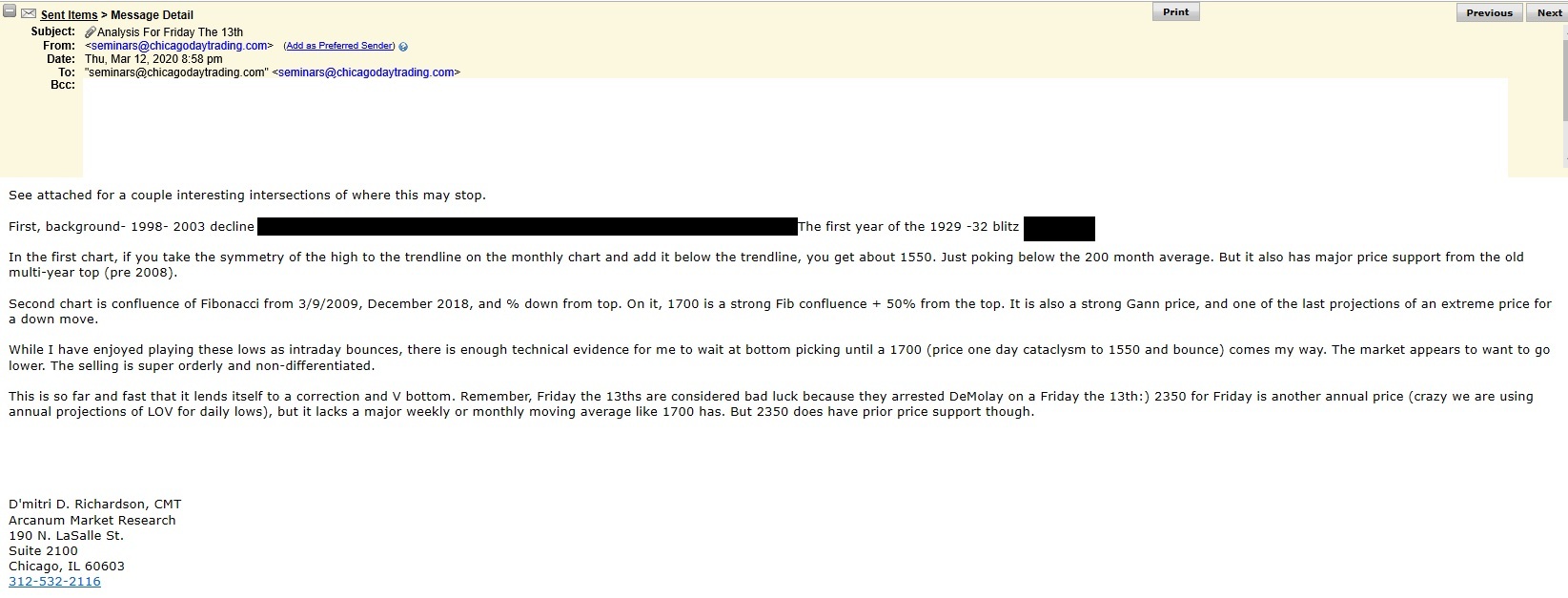

The LOV downrange target/price projection for March 13th below never comes to fruition in its allotted time period. And then its gone….

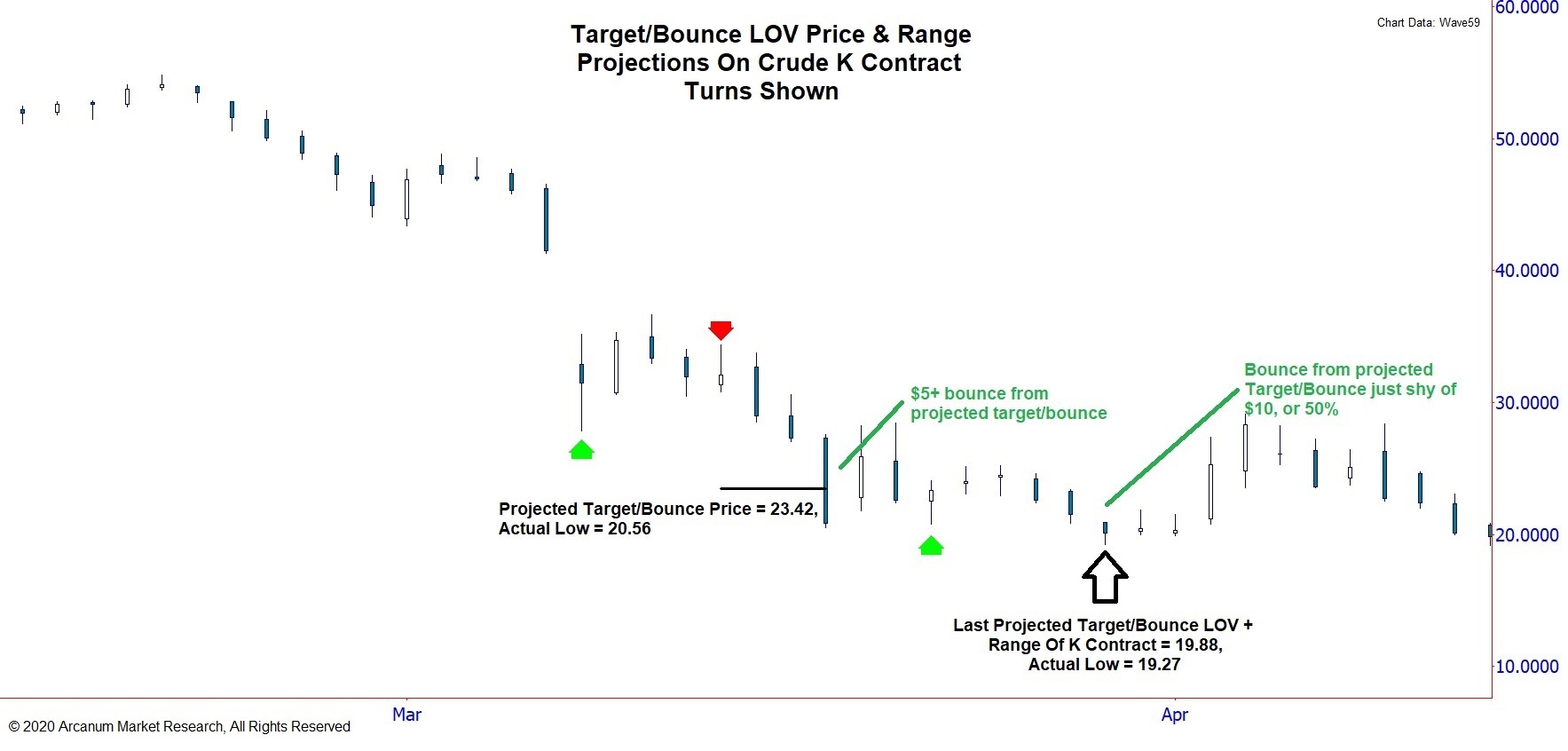

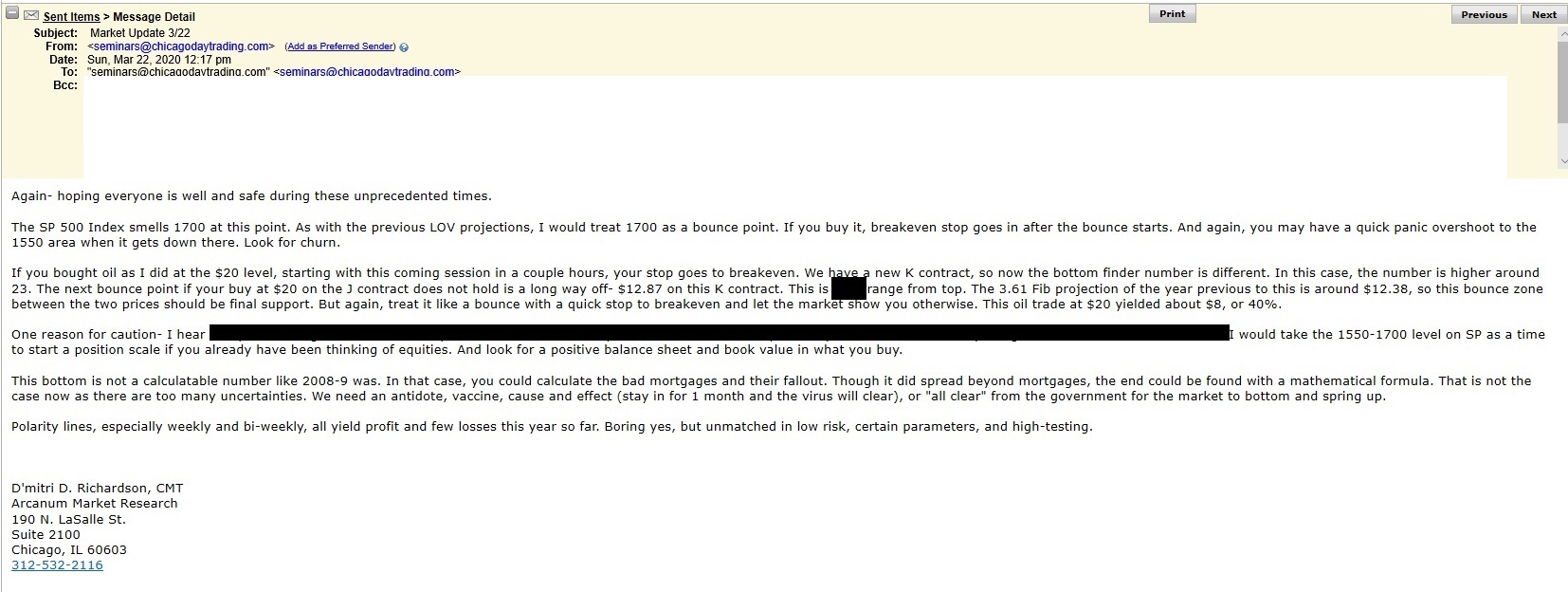

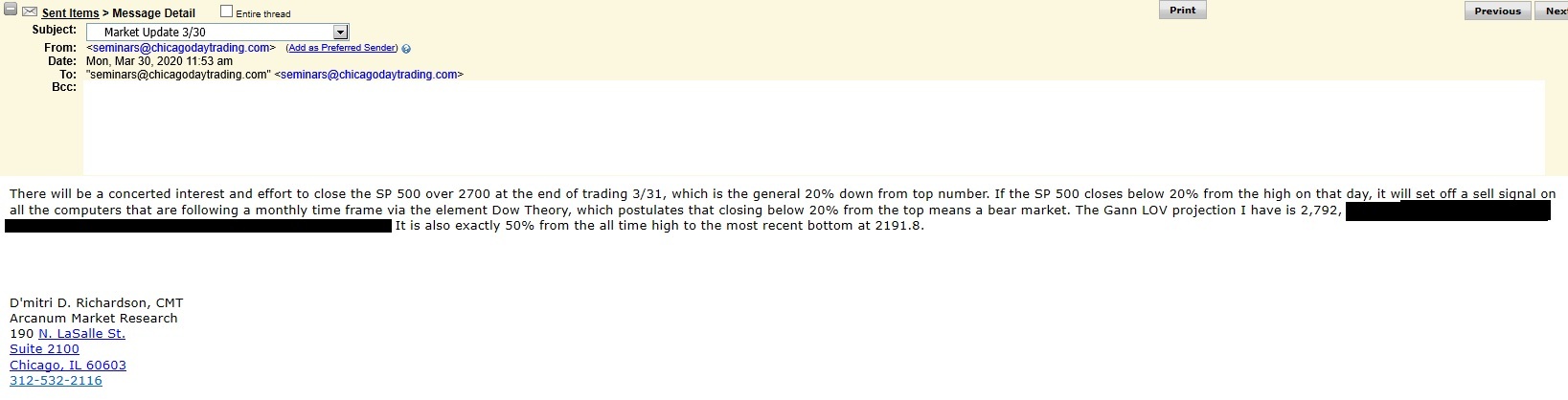

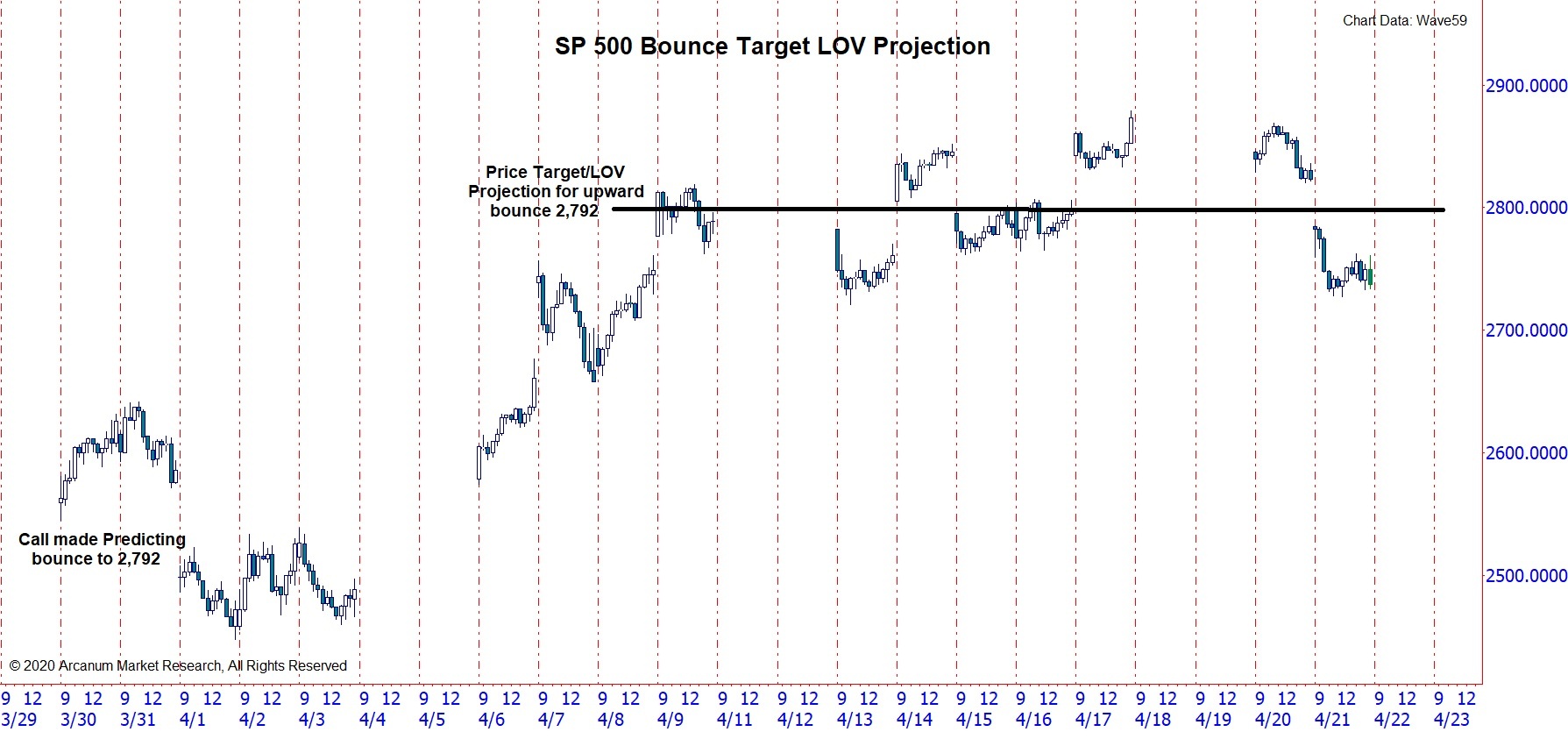

In the March 22nd and 30th updates below, we warn traders to take profits if they bought the $20 crude bounce, and warn of the impending doom on crude down to at least $12.87 via W. D. Gann’s Law of Vibration Price. On the SP 500, we forecast a bounce up to at least 2,792 off the bottom. Per Dow Theory, there would be a battle to close above this price on the last day of the month so the computers following a monthly signal stayed in “buy” mode.

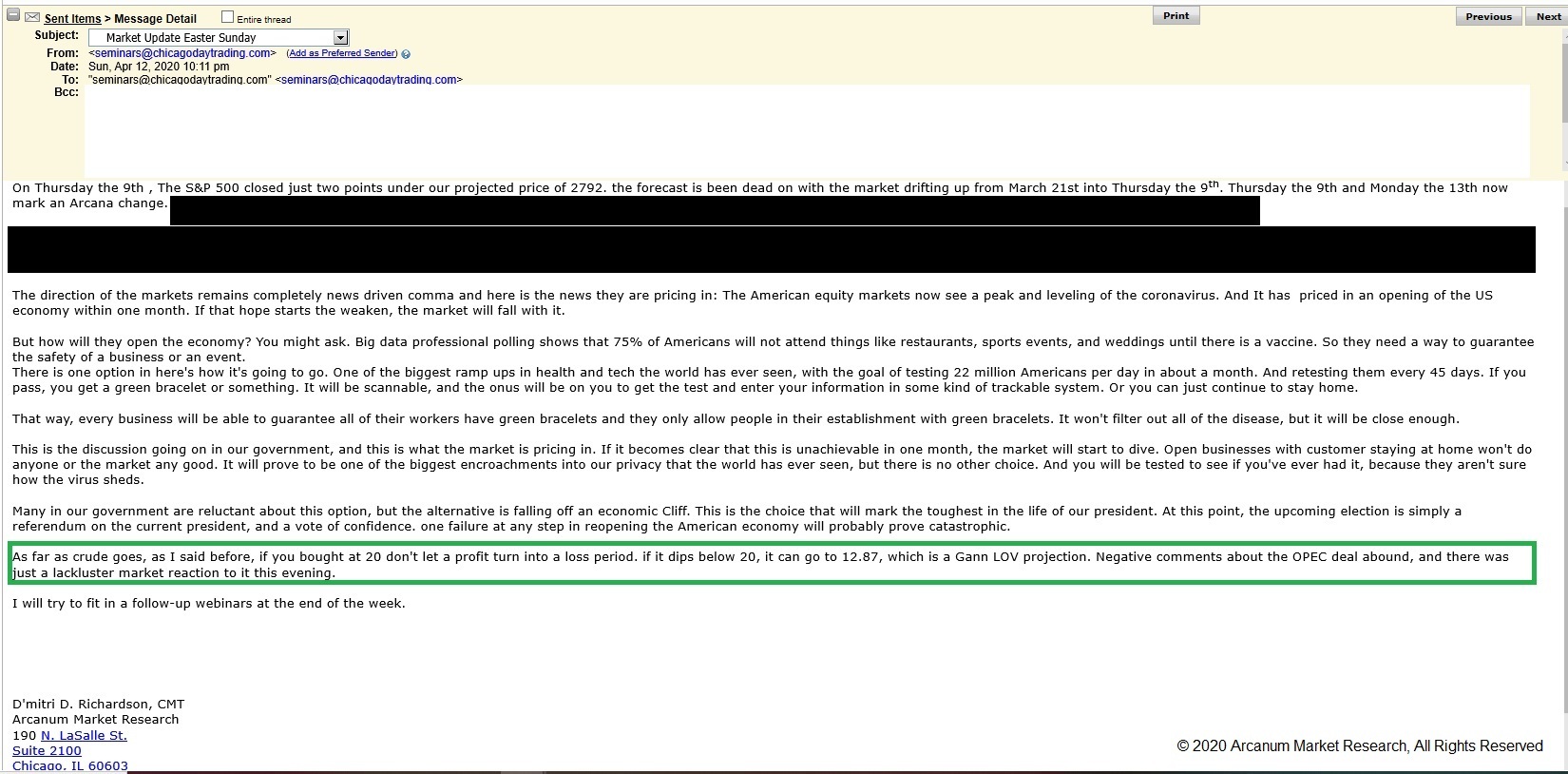

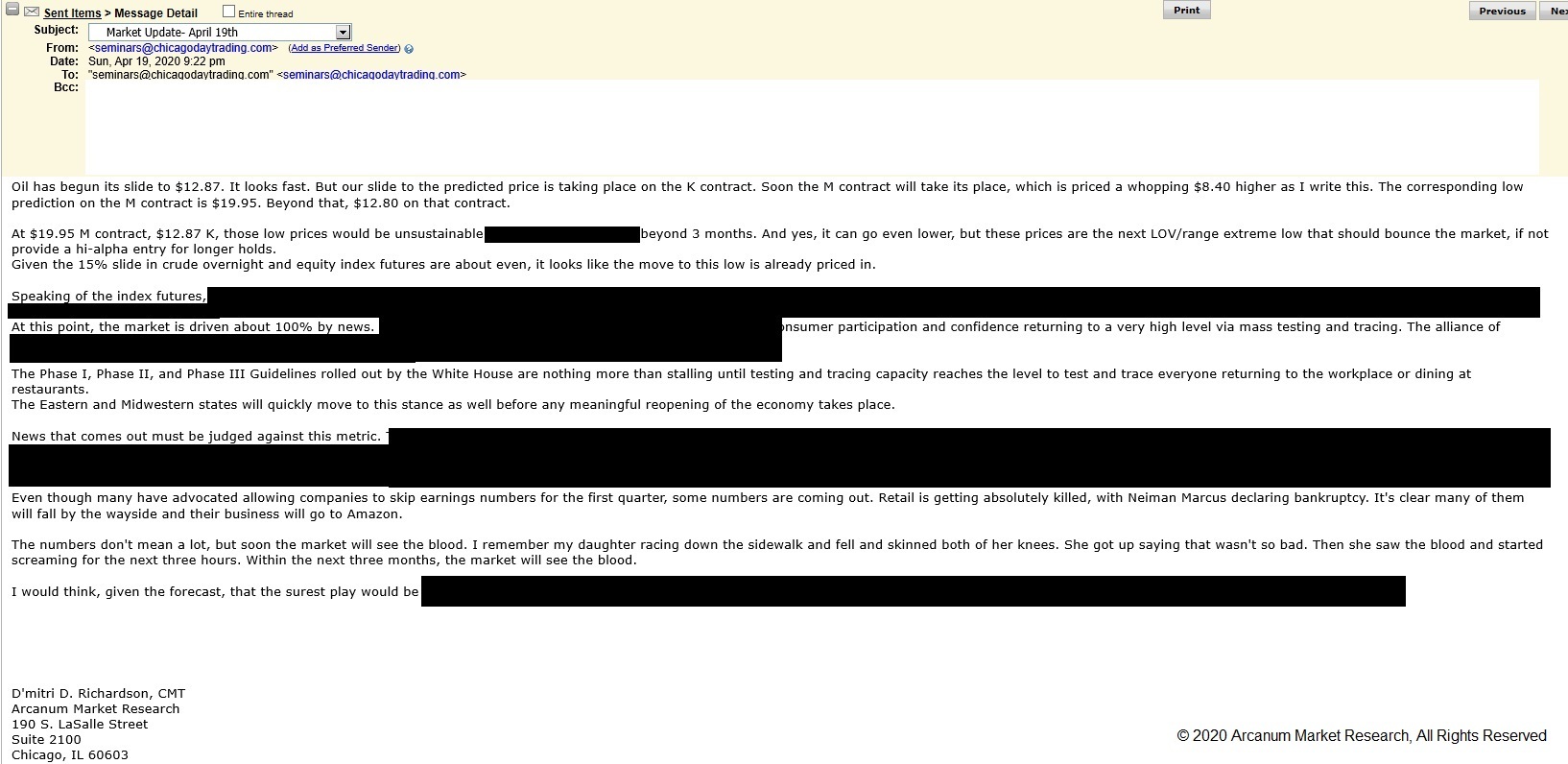

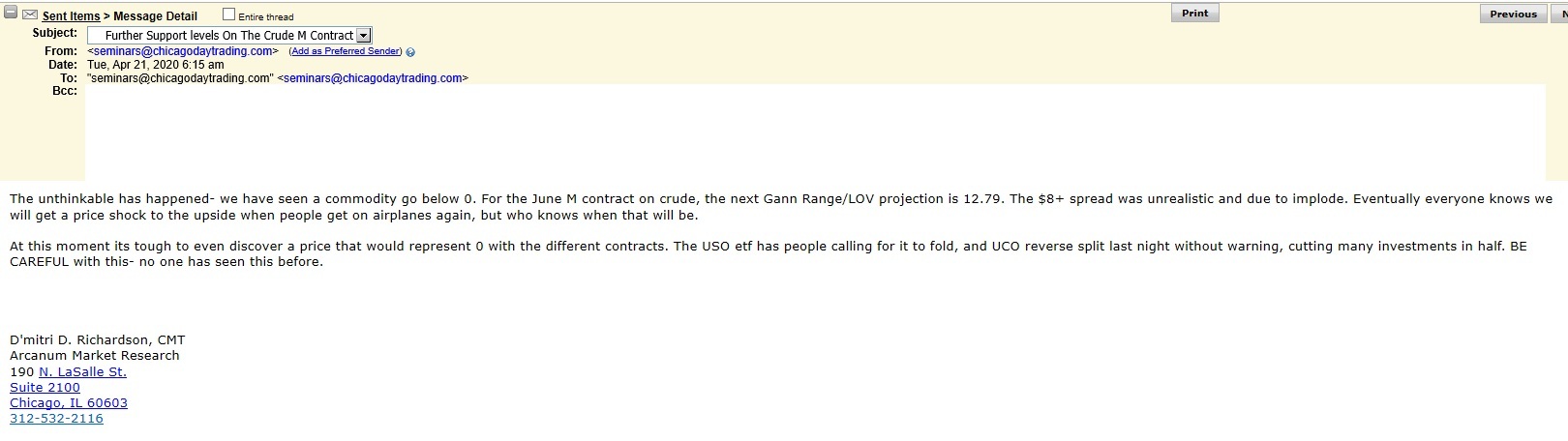

In the Easter (12th), April 19th, and April 21st updates below, we again warn of the imminent crude slide, and pass along to our clients from our sources what the opening of America will really look like (a free gift to the hundreds of people who reads this site each day). It would be well worth a re-read. Finally, since K contract is dying on its predicted low, we advise trading in the June M contract, give price targets on the crude M contract, just hours before they are actually hit.

button